California is where big ideas launch — but turning an idea into a legal business means following the rules, registering properly, paying taxes, and protecting your venture. This simple, thorough guide helps new founders and small business owners get started the right way.

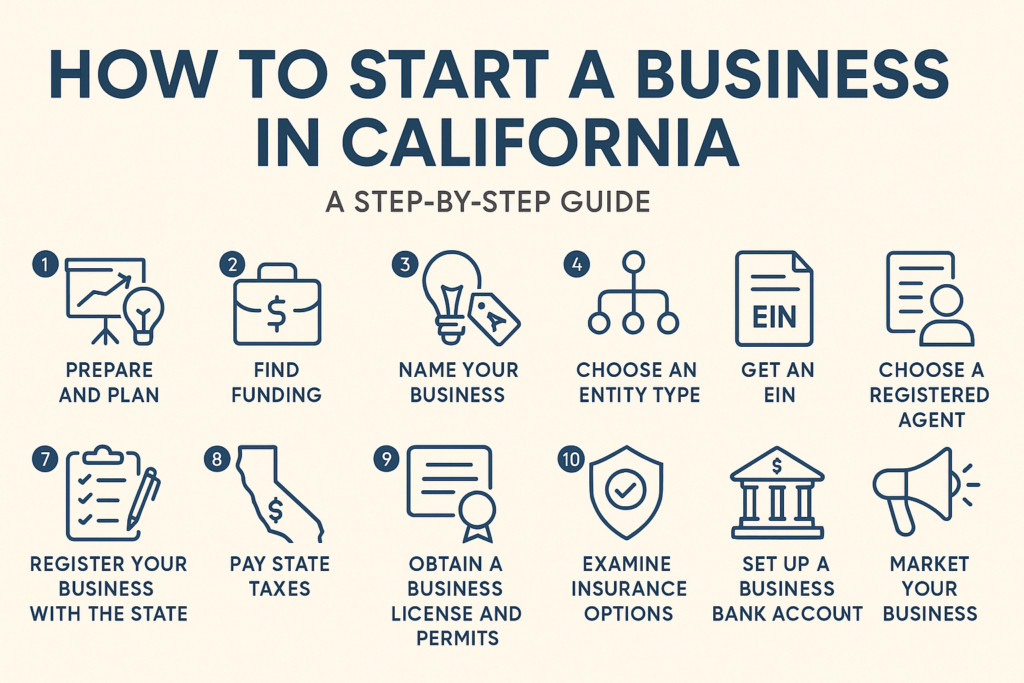

1. Prepare and Plan

Research your industry, understand your customers, and size up your competition. Build a clear plan covering what you sell, who you sell to, what sets you apart, your costs, and how you’ll make a profit.

For example, Philz Coffee started as a single neighborhood shop with a clear plan for unique, customized coffee — and grew into a popular chain.

Use free tools like the SBA Business Plan Builder to outline your idea.

2. Find Funding

Most businesses need money to get off the ground. In California, small businesses can tap savings, family loans, bank loans, or investors. The California Small Business Loan Guarantee Program helps new businesses qualify for loans.

For instance, Snap Inc. (Snapchat) started at Stanford University and scaled through early investments.

3. Name Your Business

Choose a name that’s memorable, easy to spell, and legally available:

- Search the California Secretary of State Business Search.

- File a DBA with your county clerk if you’ll use a name other than your legal name.

- Secure your domain name.

4. Choose an Entity Type

Choosing a legal structure shapes how you’ll be taxed, what paperwork you’ll need, and how much personal liability you’ll have. Here are the main options for small businesses in California:

- Sole Proprietorship: The simplest option — best for freelancers and solo businesses. You and the business are legally the same, so you’re personally responsible for debts or lawsuits.

- Limited Liability Company (LLC): A popular option for small businesses wanting liability protection without too much complexity. Owners’ personal assets are protected, and profits pass through to their personal tax returns.

- Corporation: A more complex structure that creates a separate legal entity. Personal assets are protected, and corporations can issue stock to raise money. This is a common choice for startups planning to attract investors — like Airbnb or Google did in their early days.

- Limited Liability Partnership (LLP): Usually used by licensed professionals — like law firms, architects, or accountants — who want some protection for partners against the actions of others.

5. Get an EIN

An Employer Identification Number (EIN) is like a Social Security number for your business. It’s required for hiring employees, paying taxes, opening a business bank account, and more. Applying for an EIN is free through the IRS website.

6. Choose a Registered Agent

LLCs and Corporations must name a registered agent — an individual or service that receives official legal and tax documents for your business. Your agent must have a physical address in California and be available during normal business hours. Many owners hire a professional registered agent service for privacy and convenience.

7. Register Your Business with the State

Formally register with the California Secretary of State:

- LLC: File Articles of Organization (Form LLC-1).

- Corporation: File Articles of Incorporation (Form ARTS-GS).

- LLP: File an Application to Register LLP (Form LLP-1).

- Sole Proprietor: Typically files a DBA with the local county clerk.

Important:

Every Corporation and LLC must also file a Statement of Information within the first 90 days of registering and then:

- Annually for California Stock Corporations and Foreign Corporations

- Every two years for California Nonprofit Corporations and all LLCs

You can file online through bizfile Online.

Typical Filing Fees

| Business Structure | Filing Fee | Handling | Certified Copies | Approx. Total |

| Sole Proprietorship* | Varies by county | N/A | N/A | $30–$60 (DBA Filing) |

| LLC | $70 | $5–$10 | $5–$10 per copy | ~$85–$100 |

| Corporation | $100 | $5–$10 | $5–$10 per copy | ~$115–$130 |

| LLP | $70 | $5–$10 | $5–$10 per copy | ~$85–$100 |

*DBAs are filed at your county clerk’s office.

8. Pay State Taxes

You must stay compliant with California tax rules:

- Franchise Tax: Most businesses pay an annual $800 minimum to the Franchise Tax Board (FTB).

- State Income Tax: Corporations and LLCs taxed as corporations pay 8.84%. Sole proprietors file through Form 540.

- LLC Fee: Extra fees if your LLC earns $250,000+.

- Payroll Taxes: Register with the EDD for:

- Unemployment Insurance (UI)

- Employment Training Tax (ETT)

- State Disability Insurance (SDI)

- California Personal Income Tax (PIT)

9. Obtain a Business License and Permits

Most businesses need local licenses or special permits:

- Selling alcohol? Get an ABC License.

- Selling tangible goods? Apply for a Seller’s Permit through the CDTFA.

- Check zoning, signage, or health permits with your city or county.

Use CalGold to find out what you need.

10. Examine Insurance Options

Insurance protects you against risks. Some coverage is legally required:

- General Liability: Covers injury or property damage claims.

- Workers’ Compensation: Required if you have employees (California DIR).

- Commercial Property: Covers your space and equipment.

- Professional Liability: For service providers and consultants.

- Business Interruption: Helps you recover lost income after a disaster.

Find a trusted agent at the California Insurance Department.

11. Set Up a Business Bank Account

Keep your personal and business money separate. You’ll need an EIN and your formation documents. Many businesses also get a business credit card to build credit and track expenses.

12. Market Your Business

Get the word out! Build a simple website, claim your Google Business Profile, use social media, and print flyers or signs for local exposure. Many California brands build a following through local events and community partnerships.

Other Employer Responsibilities

If you plan to hire employees, register your business as an employer and get a federal EIN if you haven’t already. As an employer in California, you’re responsible for:

- Payroll taxes and wage withholding.

- Employer tax matching for Social Security and Medicare.

- State Disability Insurance (SDI) and workers’ compensation insurance.

- Unemployment Insurance (UI) through the EDD.

- Workplace safety, health regulations, and equal employment opportunity compliance.

You’ll also need to file the right federal tax return each year, such as:

- Form 1120 (Corporation)

- Form 1120-S (S Corporation)

- Form 1065 (Partnership)

- Form 1041 (Estates & Trusts)

A quick view

Ready to Start?

Launching a business in California is a big milestone — this checklist keeps you on track and helps you stay compliant.

Helpful Resources

- California Secretary of State Business Entities

- Franchise Tax Board (FTB)

- CDTFA

- Alcoholic Beverage Control (ABC)

- EDD

- CalGold

- bizfile Online

- IRS — EIN

- California Insurance Department