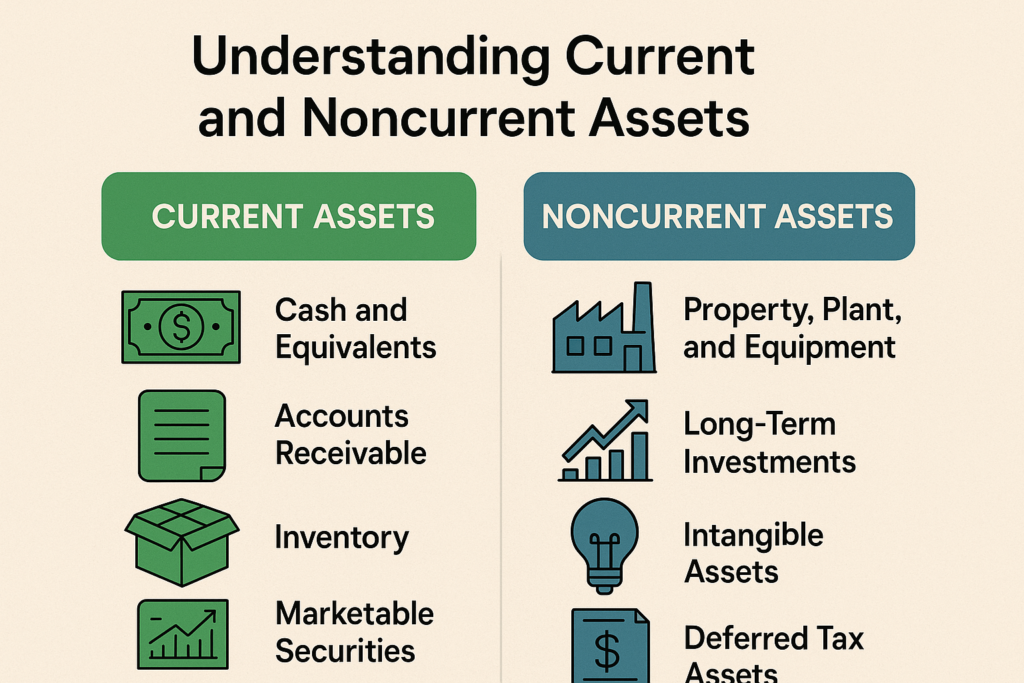

Understanding the classification of assets is fundamental to accurate financial reporting and decision-making. Businesses divide their assets into two major categories: current assets and noncurrent assets. These classifications help stakeholders evaluate a company’s liquidity, operational efficiency, and long-term financial health.

Current assets are short-term resources expected to be used, sold, or converted into cash within a year or the company’s operating cycle—whichever is longer. On the other hand, noncurrent assets are long-term investments or resources that are not intended for immediate liquidation or consumption.

This article dives deep into both categories, examines each component, outlines their differences, and explains related concepts like depreciation and fixed assets.

Current Assets

Current assets are resources that are expected to be liquidated, sold, or consumed during the normal course of business—typically within one year. These assets are critical in measuring a company’s short-term liquidity, which indicates its ability to meet immediate financial obligations.

Cash and Cash Equivalents

Cash and cash equivalents are the most liquid form of current assets. They include:

- Physical cash on hand

- Checking and savings account balances

- Treasury bills

- Commercial paper

- Money market funds

Cash equivalents are short-term investments that can be readily converted into cash with minimal risk of value change. These assets are crucial for operational flexibility and emergency funding.

Accounts Receivable

Accounts receivable (AR) represents money owed by customers for goods or services delivered on credit. Businesses typically set a credit period, such as 30 or 60 days, within which the payment is expected.

- AR is recorded net of allowances for doubtful accounts.

- High AR turnover indicates efficient credit and collection policies.

Prepaid Expenses

Prepaid expenses are payments made in advance for goods or services to be received in the future. Though not convertible to cash, they are considered current assets because the benefit will be realized within a year.

Common examples include:

- Insurance premiums

- Rent

- Subscription services

As the service period progresses, these are amortized and recognized as expenses.

Inventory

It includes raw materials, work-in-progress (WIP), and finished goods that are ready for sale. Inventory is vital for businesses that sell physical products and is usually valued using methods like FIFO (First In, First Out) or LIFO (Last In, First Out).

Managing inventory efficiently ensures smooth operations and minimizes holding costs and obsolescence.

Marketable Securities

Marketable securities are short-term investments that are highly liquid and can be quickly converted into cash. Examples include:

- Publicly traded stocks and bonds

- Government securities

These are typically held for short-term gain or to earn returns on surplus cash while maintaining liquidity.

Noncurrent Assets

Noncurrent assets (also known as long-term assets) are resources that are not expected to be consumed or converted into cash within the current accounting year. These assets contribute to long-term strategic objectives and operational capabilities.

They are typically illiquid and include physical property, intangible rights, and financial investments.

Common Examples of Noncurrent Assets:

- Property, Plant, and Equipment (PP&E): Tangible long-term assets like buildings, land, and machinery used in business operations.

- Long-Term Investments: Investments in bonds, stocks, or real estate intended to be held for more than one year.

- Intangible Assets: Non-physical assets such as patents, trademarks, copyrights, goodwill, and brand recognition.

- Deferred Tax Assets: Taxes that can be used to reduce future tax liabilities.

These assets are capitalized on the balance sheet and depreciated or amortized over their useful life (except land, which is not depreciated).

Key Differences Between Current and Noncurrent Assets

| Feature | Current Assets | Noncurrent Assets |

| Time Horizon | Used or liquidated within one year | Held for more than one year |

| Liquidity | Highly liquid | Generally illiquid |

| Purpose | Supports daily operations and working capital | Supports long-term operations and capital investment |

| Examples | Cash, receivables, inventory | Equipment, buildings, patents |

| Reporting | Top section of the balance sheet | Below current assets on the balance sheet |

| Valuation Adjustments | Rarely depreciated or amortized | Usually depreciated/amortized over time |

Understanding these differences helps financial analysts assess a company’s short-term solvency versus its long-term capital structure and growth potential.

Current Assets vs. Noncurrent Assets Example

Example: ABC Tech Solutions

ABC Tech Solutions has the following assets on its balance sheet:

- Cash and Equivalents: $100,000

- Accounts Receivable: $75,000

- Inventory: $50,000

- Prepaid Rent: $10,000

- Marketable Securities: $30,000

- Equipment: $200,000 (net of depreciation)

- Building: $500,000

- Patent: $150,000

Classification:

Current Assets:

- Cash and Equivalents – $100,000

- Accounts Receivable – $75,000

- Inventory – $50,000

- Prepaid Rent – $10,000

- Marketable Securities – $30,000

- Total Current Assets: $265,000

Noncurrent Assets:

- Equipment – $200,000

- Building – $500,000

- Patent – $150,000

Total Noncurrent Assets: $850,000

This example clearly distinguishes between short-term and long-term assets and how they are structured on the balance sheet.

What Is the Difference Between a Fixed Asset and a Noncurrent Asset?

Fixed assets are a subset of noncurrent assets. They are tangible, physical assets used in business operations and expected to provide economic benefits over multiple accounting periods. Common fixed assets include:

- Machinery

- Vehicles

- Land

- Buildings

- Office equipment

While all fixed assets are noncurrent, not all noncurrent assets are fixed. For instance, long-term investments and intangible assets like patents are noncurrent but not considered fixed.

Why Are Noncurrent Assets Depreciated?

Depreciation is the process of systematically allocating the cost of a tangible noncurrent asset over its useful life. It reflects wear and tear, obsolescence, or decline in utility. The purpose is to:

- Match costs with revenues (matching principle)

- Reflect accurate book value

- Comply with tax and accounting standards

Common depreciation methods:

- Straight-line method

- Declining balance method

- Units of production method

Example:

A $10,000 machine with a useful life of 5 years and no salvage value would be depreciated at $2,000 annually under the straight-line method.

Note: Intangible noncurrent assets (like patents) are amortized, and certain tangible assets like land are not depreciated because they do not wear out over time.

Final Thoughts

Classifying assets correctly as current or noncurrent is vital for assessing a company’s liquidity and capital structure. While current assets are essential for daily operations and short-term obligations, noncurrent assets support strategic, long-term growth. Understanding their composition, behavior, and accounting treatment empowers stakeholders to make informed business and investment decisions.