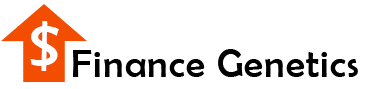

Businesses face strict deadlines when furnishing information returns to employees and contractors. Missing those deadlines can result in costly penalties and compliance risks. To help in exceptional situations, the IRS provides Form 15397, a paper-based extension request form that applies specifically to Form W-2, Form 1099, or other information returns.

This guide explains what businesses need to know about IRS Form 15397, who must file it, which forms it covers, how to complete and submit it, and the consequences of failing to comply.

What is Form 15397?

IRS Form 15397, Extension Request for Certain Information Returns, allows businesses to request additional time (typically up to 30 days) to furnish recipient copies of information returns. Unlike other IRS extensions, this form does not apply automatically. The IRS requires businesses to file Form 15397 on paper with a valid reason for delay, and approval is not guaranteed.

Approval letters will not be issued. The IRS will issue a letter only in instances of an incomplete or denied extension request.

What Forms Can Be Extended Using Form 15397?

Businesses can use Form 15397 to request additional time for furnishing recipient copies of several information returns. The IRS currently allows extensions for the following forms:

- Form 1042-S – Foreign Person’s U.S. Source Income Subject to Withholding

- Forms 1095-B and 1095-C – Health Coverage Information Returns

- Forms 1097, 1098, and 1099 series – Various information returns, including interest, dividends, and miscellaneous payments

- Form 3921 – Exercise of an Incentive Stock Option

- Form 3922 – Transfer of Stock Acquired Through an Employee Stock Purchase Plan

- Form W-2G – Certain Gambling Winnings

- Form 1099-NEC – Nonemployee Compensation

- Form 1099-QA – Distributions from ABLE Accounts

- Form W-2 – Wage and Tax Statement

- Form 5498 – IRA Contribution Information

- Form 5498-ESA – Coverdell ESA Contribution Information

- Form 5498-QA – ABLE Account Contribution Information

- Form 5498-SA – HSA, Archer MSA, or Medicare Advantage MSA Information

Each of these forms carries strict deadlines, and businesses must submit Form 15397 before the original due date to secure an extension.

When is the Due Date to File Form 15397?

Businesses must submit Form 15397 on or before the original due date of the applicable returns:

| Form Type | Actual Deadline |

| 1099-NEC | January 31 |

| 1099-QA | January 31 |

| W-2 | January 31 |

| 1095-B, 1095-C | March 2 |

| 1042-S | March 15 |

| 5498-QA | March 15 |

| 1097, 1098, 1099, 3921, 3922, W-2G | March 31 |

| 5498-ESA | April 30 |

| 5498 | May 31 |

| 5498-SA | May 31 |

If the business misses this filing date, the IRS will not grant an extension. Late furnishing can trigger immediate penalties.

What Information Does a Business Need to Complete Form 15397?

Businesses must prepare the following information before completing Form 15397:

- Business Identification – Legal name, address, and Employer Identification Number (EIN).

- Contact Person – Full name, phone number, and email of the person responsible for filing.

- Return Type – Clearly indicate which form the extension request applies to (e.g., Form 1099, W-2, 1095, 5498, etc.).

- Number of Returns Affected – An estimate of how many statements will be delayed.

- Reason for Extension – A specific and valid explanation, such as payroll software malfunction, natural disaster, or unavoidable administrative delay.

- Signature of Authorized Representative – The form must be signed by the business owner, officer, or authorized transmitter.

How to Complete Form 15397: Line-by-Line Instructions

Businesses can complete Form 15397 by following these steps:

- Line 1 – Filer’s Name and EIN

- Enter the exact legal name of the business and its Employer Identification Number.

- Line 2 – Business Address

- Provide the complete mailing address, including city, state, and ZIP code.

- Line 3 – Contact Information

- Enter the name, phone number, and email of the contact person responsible for the extension request.

- Line 4 – Type of Return

- Check the appropriate box: W-2, 1099, or other form.

- Line 5 – Number of Returns

- State how many statements will be delayed.

- Line 6 – Reason for Extension

- Provide a valid explanation. The IRS requires justification for granting the extension.

- Line 7 – Signature

- An authorized officer or transmitter must sign and date the request.

How to File Form 15397 with the IRS

Businesses must complete, sign, and submit Form 15397 on or before the due date of the recipient statements. The IRS accepts the form through the following methods:

- Online Submission – Visit the IRS Forms and Publications page, then search for Form 15397 and follow the instructions to file.

- Fax Submission – Send the completed form to:

Internal Revenue Service Technical Services Operation

Attn: Extension of Time Coordinator

Fax: 877-477-0572 (Domestic)

Fax: 304-579-4105 (International)

Businesses should retain a copy of the filed form and proof of mailing for compliance purposes.

What are the Penalties for Not Filing Form 15397?

If a business fails to furnish recipient statements by the due date and does not obtain an approved extension, the IRS may assess penalties. For the 2025 tax year, the penalties are as follows:

| Filing Status | Penalty per Return |

| Up to 30 days late | $60 |

| 31 days late through August 1 | $130 |

| After August 1 or not filed | $330 |

| Intentional disregard | $660 |

Small businesses with annual gross receipts under $5 million face lower maximum penalties, but the per-return penalty rates remain the same.

FAQs About Form 15397

Q1. How does a business know if the extension was accepted?

The IRS does not send automatic confirmations. If the business does not receive a rejection or follow-up, the extension is generally considered approved.

Q2. Does a business need to provide a reason for a Form 15397 extension?

Yes. Unlike some other extensions, the IRS requires a specific and valid explanation before granting approval.

Q3. Can a business apply for an extension after the deadline?

No. The extension request must be filed by the original due date of the return. Late applications will not be considered.

Q4. What types of rejection may occur for Form 15397?

Rejections can occur if the form is incomplete, the reason for extension is insufficient, or if the IRS determines the filer does not qualify.

Q5. What is the difference between Form 8809 and Form 15397?

- Form 8809 extends the filing deadline for many information returns, including several 1099-series forms.

- Form 15397 applies only to furnishing recipient copies of information returns.

Final Thoughts

Businesses cannot afford to miss critical filing deadlines for Form W-2, 1099, or other information returns. When unexpected circumstances make compliance impossible, Form 15397 provides a lifeline by allowing a short extension. However, the IRS requires a valid reason, and submission by the original due date.

By preparing early and filing Form 15397 when necessary, businesses can reduce the risk of penalties, protect compliance, and maintain smoother year-end reporting.