Note: If you already filed Form 4868 (Automatic Extension for Individual Income Tax Return) or Form 2350 (Extension for U.S. citizens abroad) and you do not expect to owe gift or GST tax, you don’t need to file Form 8892. But if you do owe gift or GST tax, you must use Form 8892-V Payment Voucher to make the payment.

What is Gift or GST Tax?

Before diving deeper, let’s clarify these taxes:

- Gift Tax: A federal tax imposed on the transfer of money or property from one individual to another when nothing (or less than fair market value) is received in return. For 2025, the annual exclusion is $18,000 per recipient.

- Generation-Skipping Transfer (GST) Tax: A tax on transfers to beneficiaries who are more than one generation younger than the donor (for example, a grandparent giving assets directly to a grandchild).

Form 709 is the main return used to report these transactions, and Form 8892 provides extra time to file it when necessary.

When is the Deadline to File Form 8892?

- Form 709 (U.S. Gift and GST Return) and Form 709-NA (Gift Tax Return for Nonresident Not Citizens) are both due on April 15 of the year following the calendar year in which the gift was made.

- If April 15 falls on a weekend or federal holiday, the deadline shifts to the next business day.

- Filing Form 8892 grants an automatic six-month extension — typically until October 15.

Tip: If you already filed Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return), you automatically receive the same extension for Form 709. You do not need to file Form 8892 separately unless you also want an extension to pay gift or GST tax.

What Information is Required to Complete Form 8892?

To complete Form 8892, you will need:

- Taxpayer’s name and Social Security Number (SSN).

- Spouse’s name and SSN (if applicable).

- Current address.

- Total gift tax or GST tax expected to be due.

- The amount of tax you are paying with the extension request.

- Signature and date.

How to Complete Form 8892 – Line by Line Instructions

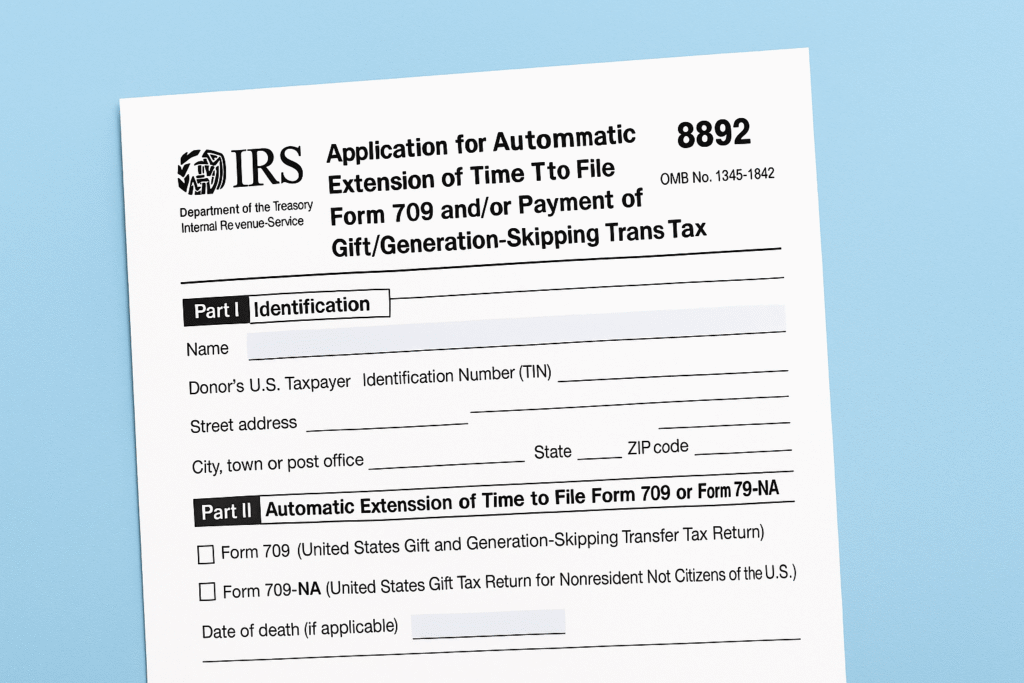

Completing IRS Form 8892 correctly is essential to avoid IRS rejection and penalties. The form is divided into three main parts: Identification, Automatic Extension, and Payment of Gift/GST Tax (with voucher Form 8892-V). Below is a detailed guide to each section.

Before You Begin: Determine If You Must Use Form 8892

The IRS provides a quick-use chart to help taxpayers know when Form 8892 is required:

- If you filed Form 4868 or Form 2350 and do not expect to owe gift or GST tax → You do not need Form 8892.

- If you filed Form 4868 or Form 2350 and expect to owe gift or GST tax → Use Form 8892-V (Payment Voucher) to make the payment.

- If you need to extend the time to file Form 709 or Form 709-NA but are not requesting an extension for your individual income tax return → Use Form 8892 and, if applicable, include Form 8892-V for payments.

This decision step ensures you don’t file unnecessary paperwork.

Part I – Identification

In this section, you provide the taxpayer’s personal information:

- First Name and Initial – Enter the donor’s first name.

- Last Name – Enter the donor’s surname.

- Donor’s U.S. Taxpayer Identification Number (TIN) – Generally, this will be the Social Security Number (SSN). If you are a nonresident alien donor, follow IRS instructions for the appropriate TIN.

- City, Town, or Post Office – Enter the city where you reside.

4a. Street Address – Enter your street address. If using a P.O. Box, see the IRS instructions.

4b. Apt. Number – If applicable, list your apartment or suite number. - State – Your U.S. state of residence.

- ZIP Code – Five-digit postal code.

- Foreign Country Name – Only if applicable, list your country of residence.

- Foreign Province/State/County – For foreign addresses.

- Foreign Postal Code – Required if living abroad.

This section helps the IRS match your extension request to your taxpayer record.

Part II – Automatic Extension of Time to File Form 709 or Form 709-NA

- Check the box for Form 709 (United States Gift and Generation-Skipping Transfer Tax Return) if you need a six-month automatic extension.

- Check the box for Form 709-NA (United States Gift Tax Return for Nonresident Not Citizens of the U.S.) if applicable.

- If the donor died during the tax year, you must also provide the date of death.

This section ensures the IRS knows whether you are requesting an extension for a U.S. taxpayer or a nonresident donor.

Part III – Payment of Gift and/or GST Tax (Using Form 8892-V Voucher)

If you owe gift or GST taxes, complete Part III along with the detachable Form 8892-V Payment Voucher.

- Line 1 – Tax Year: Enter the applicable calendar year.

- Line 2 – Gift Tax from Form 709: Enter the amount of gift tax you expect to owe.

- Line 3 – Gift Tax from Form 709-NA: If applicable, enter the tax due from the nonresident return.

- Line 4 – GST Tax from Form 709: Enter the amount of GST tax owed.

- Line 5 – GST Tax from Form 709-NA: Enter the GST tax liability for nonresident returns.

If you are filing Part III only, you must also provide the following identification details in Lines 6–10:

- First Name and Initial

- Last Name

- Donor’s U.S. Taxpayer Identification Number (SSN or other TIN)

9a. Street Address (or P.O. Box if no street delivery)

9b. Apartment Number (if applicable) - City, State/Province, Country, and ZIP or Foreign Postal Code

Attach your payment (check or money order payable to “United States Treasury”) and send it with the voucher to the IRS mailing address for your location.

Example Scenario

Suppose you made gifts exceeding the annual exclusion amount in 2024 and expect to owe federal gift tax. You file Form 4868 for an income tax extension, but since you also owe gift tax, you must:

- Complete Form 8892 Part I with your personal details.

- Check the Form 709 box in Part II to extend your gift tax return.

- Use Part III and Form 8892-V to make a payment toward your estimated gift tax.

This way, you extend your filing deadline to October 15, 2025, while ensuring partial payment reduces penalties and interest.

How to File Form 8892

You can file Form 8892 By Mail – Mail the completed form to the correct IRS address (see below). Include a check or money order if paying taxes due.

Best practice: Always attach proof of mailing (such as certified mail or delivery confirmation) when sending tax forms by mail.

Where to Mail Form 8892?

File Form 8892 at the following address.

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999

Always double-check the most recent IRS instructions for updates to mailing addresses.

Final Thoughts

IRS Form 8892 is a vital tool for taxpayers who need extra time to file Form 709 (Gift and GST Tax Return) or arrange payment of gift or GST tax liabilities. While it grants a six-month filing extension, it does not extend the time to pay. Filing timely and making partial payments can help minimize penalties and interest.

Whether you are an individual making large gifts, a taxpayer with GST obligations, or an executor handling estate matters, understanding Form 8892 ensures smooth compliance with IRS requirements.

FAQs on Form 8892

Q1. Is filing Form 8892 the same as filing for an extension of income taxes?

No. Form 8892 is specific to gift, GST, and estate taxes, not income taxes. For income taxes, use Form 4868.

Q2. Can I get an extension to pay gift tax through Form 8892?

Yes, you can request additional time to pay. However, interest still accrues, and penalties may apply if full payment isn’t made by the due date.

Q3. Do I need to file Form 8892 if I already filed Form 4868?

Not necessarily. Form 4868 automatically extends the time to file Form 709. But if you also need an extension to pay, you must file Form 8892.

Q4. What happens if I don’t file Form 8892 and miss the deadline?

You may face penalties for late filing and interest on unpaid gift or GST tax. Filing Form 8892 helps you avoid the late filing penalty.Q5. Can Form 8892 be filed jointly for married couples?

Yes. Married couples can file one Form 8892 if both made gifts that require filing. Both spouses must sign the form.