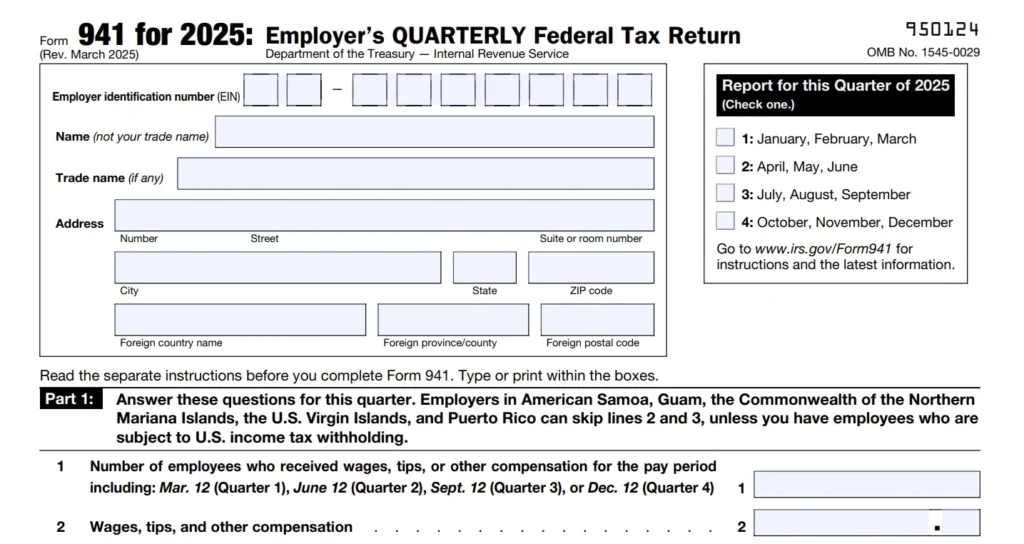

For business owners, one of the most important quarterly tax responsibilities is filing IRS Form 941, the Employer’s Quarterly Federal Tax Return. This form is used to report wages paid to employees, along with federal income taxes withheld and both the employer and employee portions of Social Security and Medicare taxes.

While many businesses file Form 941 electronically, others still prefer or are required to file by paper. One of the most common questions from paper filers is:

“Where do I mail Form 941?”

This guide will walk you through the basics of filing Form 941 by paper, and more importantly, provide the correct IRS mailing address based on your state and whether you’re including a payment.

What Is Form 941?

Form 941 is filed every quarter by employers to report:

- Wages paid

- Tips received

- Federal income tax withheld

- Employer and employee shares of Medicare and Social Security taxes

- Applicable tax credits (such as COBRA or qualified sick leave credits, if applicable)

The IRS requires that most businesses file this form four times per year—by the last day of the month following the end of each quarter.

The IRS encourages all employers to file Form 941 electronically for faster processing and fewer errors. You can visit IRS.gov/EmploymentEfile to learn more about e-filing options and approved providers.

How to File Form 941 by Paper?

If you’re filing Form 941 by paper instead of electronically, here’s what you need to do:

- Download the Latest Form: Always use the current version of Form 941, which you can download directly from the IRS website at irs.gov.

- Complete the Form Accurately: Fill in all applicable fields including your Employer Identification Number (EIN), business name and address, total wages, tax amounts, and any adjustments or credits.

- Include Payment (If Applicable): If you owe a balance, include a check or money order made payable to United States Treasury. Also include Form 941-V, the payment voucher.

- Sign the Form: A paper Form 941 is not valid unless signed by the business owner or authorized representative.

- Mail to the Correct IRS Address: The IRS has different mailing addresses depending on your business location and whether you are sending a payment along with the return. Sending it to the wrong address can result in delays or non-processing.

Important: Private Delivery Services (PDSs) can’t deliver to P.O. boxes. If the IRS address for your filing includes a P.O. box, you must use the U.S. Postal Service (USPS) to mail your form.

To find a list of approved PDSs, visit IRS.gov/PDS

Recent changes in Form 941 Mailing Address

According to IRS Publication 3891, the IRS has recently shifted some mailing destinations for Form 941 submissions. Previously, employers in several states sent Form 941 with a payment to the IRS lockbox in Cincinnati, OH. Under the latest update, those returns are now directed to the IRS lockbox in Louisville, KY.

This realignment is part of the IRS’s ongoing efforts to balance processing workloads and streamline payment handling across its lockbox network.

Where to Mail Form 941?

If you prefer to file a paper return, the mailing address depends on whether you’re sending a payment with Form 941 or not. Check the official IRS address table below to find the correct mailing location based on your state and payment status.

Form 941 Mailing Address 2026

| Business Location (State or Territory) | If Including Payment – Mail to | If Not Including Payment – Mail to |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

| No legal residence or principal place of business in any state (includes American Samoa, Guam, Northern Mariana Islands, Puerto Rico, U.S. Virgin Islands, or foreign address) | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

📌 Important Reminders

- Postmark counts: If you’re using the U.S. Postal Service, your form is considered filed on time based on the postmark date.

- Use proper postage: IRS does not accept postage due mail.

- Keep proof of mailing: Consider using Certified Mail or another trackable service to retain evidence of timely filing.

- Check for updates: Always double-check the IRS website before mailing, as addresses may change.

Frequently Asked Questions on Form 941 Mailing Address

1. Can I mail Form 941 after the deadline?

Yes, you can still mail Form 941 after the deadline, but it may result in IRS penalties and interest for late filing or late payment. The IRS recommends filing as soon as possible to reduce penalties. If you need more time, consider requesting an extension under special circumstances or contact the IRS for assistance.

2. Do I need to mail Form 941 if I paid zero wages?

Yes, even if your business paid no wages during the quarter, you must still file Form 941 to report zero wages—unless the IRS has informed you in writing that you are not required to file for that period. Filing a “zero return” helps keep your business tax records current.

3. Can I file Form 941 electronically instead of mailing it?

Yes, the IRS strongly encourages employers to e-file Form 941. Electronic filing is faster, more accurate, and provides confirmation of receipt. You can e-file using an IRS-authorized e-file provider or payroll software that supports Form 941 submissions.

4. What happens if I mail Form 941 to the wrong address?

If Form 941 is mailed to the wrong IRS address, it can delay processing and may lead to penalties for late filing. Always double-check the mailing address for your state and whether you’re including a payment or not, as that determines where to send your return.

5. Can I send Form 941 and payment in the same envelope?

Yes, if you’re mailing Form 941 with a payment, you can include both in the same envelope. However, be sure to use the correct mailing address for returns with payment, which differs from the address for returns without payment.

6. How do I know if the IRS received my mailed Form 941?

You can confirm receipt by using certified mail with return receipt or by checking with your bank to see if your payment has cleared. The IRS does not automatically send confirmation for paper-filed returns.

7. What should I do if I recently changed my business address?

If your business mailing address has changed, notify the IRS by submitting Form 8822-B (Change of Address or Responsible Party). Make sure your new address is updated before mailing Form 941 to ensure future correspondence reaches you.

8. Can I use private delivery services to send Form 941?

Yes, the IRS accepts private delivery services such as FedEx, and DHL for Form 941. Be sure to use the approved IRS-designated private delivery addresses, which are different from standard USPS mailing addresses.

9. What if I’m filing Form 941 for multiple business locations?

Each Employer Identification Number (EIN) requires a separate Form 941 filing. Mail each return to the appropriate IRS address based on the business location associated with that EIN.

✅ Final Thoughts

Filing Form 941 accurately and mailing it to the correct IRS address ensures your business stays compliant with federal tax regulations. Whether you’re filing with or without a payment, using the correct address helps avoid processing delays, penalties, or returned forms.

For businesses that still prefer or are required to use paper filing, following the right process can make quarterly filing smoother and stress-free.