Social Security tax is something most employees see on their pay stubs every payday, but not everyone understands what it really means. Where does that money go? Who is required to pay it? How does it affect your income? And when can you expect to benefit from it? This article walks you through everything you need to know about Social Security tax in a simple, clear way.

What Is Social Security Tax and Why Do We Pay It?

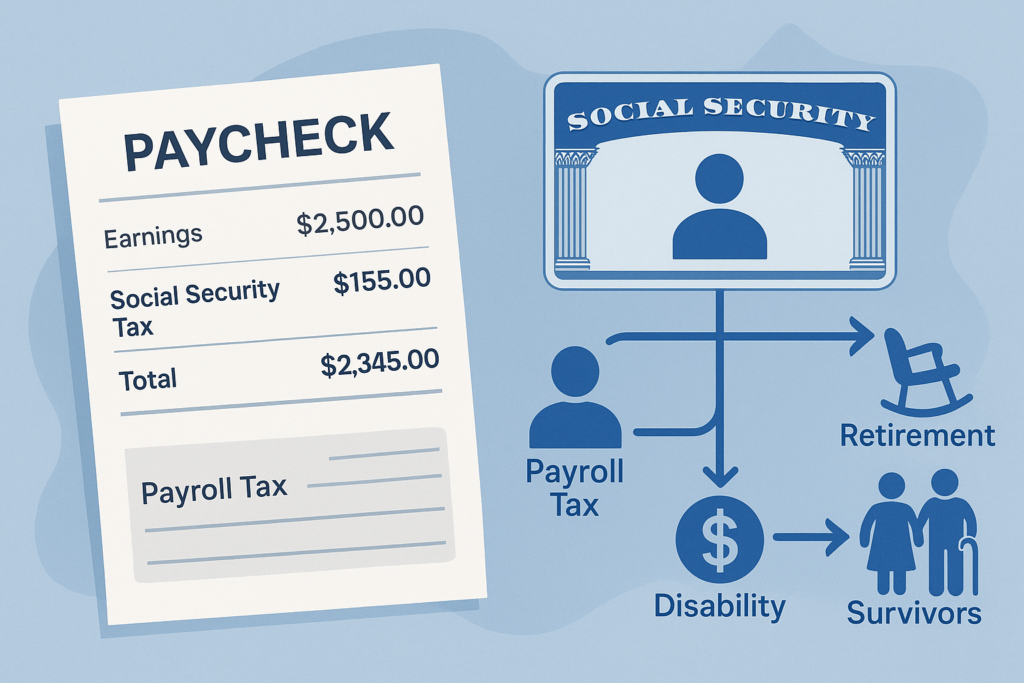

Social Security tax is a federal payroll tax that funds the Social Security program, which provides retirement income, disability benefits, and survivor support to eligible individuals. The idea behind the tax is simple: today’s workers contribute a portion of their earnings to support current retirees, people with disabilities, and families of deceased workers. In return, those same workers will be eligible for benefits when they retire or face unexpected hardships in the future.

This system ensures a continuous cycle of support—a safety net for all working Americans.

Is Everyone Required to Pay Social Security Tax?

In most cases, yes. Anyone earning income through employment or self-employment in the United States is generally subject to Social Security tax. However, there are a few exceptions:

- Certain religious group members may be exempt if they oppose public insurance systems for religious reasons.

- Nonresident aliens working under specific visa programs may not have to pay Social Security tax.

- Some state and local government employees who participate in alternate retirement systems may also be exempt.

Still, for the majority of people, paying into Social Security is a required and automatic part of earning wages.

How Social Security Tax Affects Your Paycheck

If you’re an employee, your employer withholds Social Security tax directly from your paycheck. The rate is currently 6.2% of your gross wages, up to a set annual wage limit. In addition to the amount you pay, your employer contributes an equal 6.2% on your behalf.

That means, for every dollar you earn (up to the wage cap), 12.4% is contributed to Social Security—half from you, half from your employer.

For example, if your annual salary is $60,000:

- You will pay $3,720 (6.2%) in Social Security tax

- Your employer will also pay $3,720

- The total contribution to the system is $7,440

If you’re self-employed, you’re responsible for paying both halves of the tax—a total of 12.4%. However, you can deduct half of this amount when you file your income tax return, which helps reduce your taxable income.

Is There a Limit to How Much You Pay?

Yes. Each year, the government sets a maximum income level—known as the Social Security wage base limit—on which Social Security tax can be applied. For 2025, the limit is $168,600. This means that once your annual earnings exceed this threshold, you will no longer pay Social Security tax on income above that amount.

This cap is reviewed and typically adjusted every year based on changes in average wages.

Where to Report Social Security Tax

Employers are responsible for reporting and depositing Social Security tax using Form 941, Employer’s Quarterly Federal Tax Return. This includes both the employee’s and employer’s share of the tax.

Additionally, employers must file Form W-2 each year to report wages and Social Security tax withheld for each employee. Copies of the W-2 are sent to both the IRS and the Social Security Administration, ensuring accurate credit to the employee’s earnings record.

Self-employed individuals report their Social Security tax using Schedule SE, which is attached to their Form 1040 income tax return.

Proper and timely reporting ensures that workers receive correct credit toward their future Social Security benefits.

What Happens If You Report Incorrect Information?

Reporting incorrect Social Security tax data—whether you’re an employer or an individual—can cause serious issues.

For Employers:

- Penalties and interest may be charged for incorrect or late filings.

- Incorrect employee earnings can affect future Social Security benefits.

- Employers may need to file corrections:

- Form 941-X for payroll tax corrections

- Form W-2c to fix W-2 errors

For Employees:

- A wrong W-2 can result in underreported income or incorrect tax payments.

- It can lead to delayed or reduced benefits if the SSA doesn’t credit the correct earnings.

- You should contact your employer and ask for a corrected W-2 (Form W-2c).

For Self-Employed Individuals:

- Mistakes on Schedule SE may result in underpayment or overpayment.

- You may need to file Form 1040-X to amend your return.

- Incorrect reporting can reduce your future benefit eligibility.

To avoid these problems:

- Double-check employee names, SSNs, and earnings before filing.

- Use accurate payroll records.

- Keep copies of pay stubs and filed forms.

When Can You Start Receiving Social Security Benefits?

Workers can begin receiving retirement benefits from Social Security as early as age 62. However, claiming benefits before reaching your Full Retirement Age (FRA)—which depends on your birth year—will result in reduced monthly payments.

For example:

- If you were born in 1960 or later, your full retirement age is 67.

- Taking benefits at 62 would reduce your monthly payout by about 30%.

- Waiting until age 70 increases your monthly benefit due to delayed retirement credits.

The Social Security Administration calculates your benefit based on your highest 35 years of earnings. So, the longer and more consistently you work (and pay Social Security tax), the greater your eventual benefit may be.

How Social Security Tax Fits Into a Bigger Picture

Social Security tax is not just about retirement. It also funds programs that provide:

- Disability Insurance for individuals who can no longer work due to illness or injury

- Survivor Benefits for family members of deceased workers

- Dependent Benefits for spouses and children of retired or disabled workers

These programs serve as a lifeline for millions of Americans who face unexpected challenges. The contributions you make today could support someone in crisis tomorrow—and eventually, someone else’s contributions may help support you.

The “One Big Beautiful Bill” and Social Security Tax Relief: What It Really Means

In 2025, a new federal law informally known as the “One Big Beautiful Bill” was signed to provide targeted tax relief to older Americans receiving Social Security benefits. This bill has sparked widespread interest—and some confusion—especially around how it impacts Social Security taxation.

Here’s what it actually does and does not do.

✅ What the Bill Does:

- It introduces a special standard deduction for seniors aged 65 and older:

- $6,000 for single filers

- $12,000 for married couples where both spouses are 65 or older

- If the taxpayer’s income (excluding Social Security) is below the threshold, this deduction may completely offset any taxable portion of Social Security benefits.

- As a result, an estimated 90% of seniors will no longer owe federal income tax on their Social Security benefits, at least through 2028.

This makes retirement income less taxable for lower- and middle-income seniors, helping them keep more of their monthly checks.

❌ What the Bill Does NOT Do:

- It does not eliminate Social Security payroll tax (the 6.2% withheld from your paycheck).

- It does not remove taxation of benefits for everyone — only those 65 or older who meet income limits.

- It is not a permanent change — this deduction is temporary and set to expire after 2028 unless extended by Congress.

⚠️ Common Misconception:

Some headlines and social media posts have incorrectly stated that “Social Security is no longer taxed.” This is misleading. The law provides tax relief on benefits — it does not repeal Social Security taxation entirely.

What About Medicare Tax? Is That Different?

Yes, Medicare tax is separate from Social Security tax, though both appear on your paycheck under the category of FICA taxes (Federal Insurance Contributions Act). Medicare tax is 1.45% of all wages, and it has no wage cap. High-income earners may also be subject to an additional 0.9% Medicare surtax if their wages exceed certain thresholds.

Earning Credits Toward Benefits

To qualify for Social Security benefits, you need to earn credits by working and paying Social Security tax. In 2025, you earn one credit for every $1,730 in wages, up to four credits per year. Most people need 40 credits (equivalent to 10 years of work) to qualify for retirement benefits.

The more years you work and the more you earn, the stronger your record—and the higher your potential benefit.

What Happens If You Overpay Social Security Tax?

Sometimes, people work multiple jobs and exceed the wage base limit without realizing it. If too much Social Security tax is withheld in a year, you can claim a refund when filing your federal tax return.

Final Thoughts

Social Security tax isn’t just a deduction—it’s a contribution to a vital system that supports millions of Americans. Whether you’re just entering the workforce or nearing retirement, understanding how it works helps you take control of your financial future. By paying into the system, you’re not just investing in your own well-being—you’re helping build a stronger safety net for everyone.