When Arkansas corporations or S corporations need more time to file their state income tax returns, they can request an official filing extension through Form AR1155. However, many filers misunderstand what the form actually does, when it must be filed, and how it differs from a federal extension.

This detailed guide covers everything about Arkansas Form AR1155 – Request for Extension of Time for Filing Income Tax Returns, including its purpose, who must file, filing deadlines, step-by-step instructions, mailing address, and common questions.

What Is the Purpose of Form AR1155?

Form AR1155 is used by Arkansas business taxpayers to request additional time to file their state income tax returns. It grants an extension to file, not an extension to pay.

If a business cannot complete its Arkansas corporate or S corporation return (Form AR1100CT or AR1100S) by the due date, Form AR1155 allows them to ask the Arkansas Department of Finance and Administration (DFA) for more time—up to six months in most cases.

However, all taxes owed must still be paid by the original due date of the return. Any unpaid balance after the due date will accrue interest and penalties, even if the extension is approved.

Key Points:

- Grants extra time to file, not to pay taxes.

- Can be used by Corporations, S corporations, and exempt organizations.

- Can extend filing time up to 180 days (six months).

- Must be filed on or before the original due date of the return.

Who Must File Form AR1155?

Form AR1155, Extension of Time to File, must be filed by business entities or organizations that need additional time to submit their Arkansas income tax returns. The following taxpayers are eligible and may use this form to request an extension:

- C Corporations (Form AR1100CT) – Corporations that file Arkansas Corporate Income Tax Return and require more time to file beyond the original due date.

- S Corporations (Form AR1100S) – Businesses electing S Corporation status under federal law that must file the Arkansas S Corporation Income Tax Return.

- Cooperative Associations (Form AR1100CT) – Cooperatives that file under corporate tax provisions and need an extension for their state return.

- Exempt Organizations (Form AR1100CT) – Nonprofit or tax-exempt organizations required to file an Arkansas return and need extra time to prepare accurate filings.

You must file Form AR1155 if any of the following apply:

- You have not filed a federal extension (Form 7004) and need an Arkansas-only extension of up to 180 days to file your state return.

- You have already filed a federal extension but need additional time beyond the federal extension period to complete your Arkansas return.

However, if you have a valid federal extension that covers the same filing period and you do not need extra Arkansas-only time, you are not required to submit Form AR1155.

When Is the Deadline to File Form AR1155?

The filing deadline for Form AR1155 depends on whether a federal extension has been filed and what type of extension is requested.

1. For Calendar-Year Filers

- The original due date for most corporations and S corporations is the 15th day of the fourth month after the end of the tax year.

- Example: For a tax year ending December 31, 2024, the due date is April 15, 2025.

- If you want to request an Arkansas-only extension (up to 180 days), Form AR1155 must be filed on or before April 15, 2025.

2. For Fiscal-Year Filers

- The due date is the 15th day of the fourth month following the close of your fiscal year.

- Example: If your fiscal year ends on June 30, the return is due October 15.

- The extension request (AR1155) must be filed by that original due date.

3. If You Have a Federal Extension

- If you’ve already filed IRS Form 7004 for your federal return, Arkansas automatically grants the same extension.

- You don’t need to submit AR1155 unless you want an additional Arkansas-only 60-day extension beyond the federal deadline.

Timely submission is crucial. Filing Form AR1155 after the original due date makes the extension request invalid, and late filing penalties will apply.

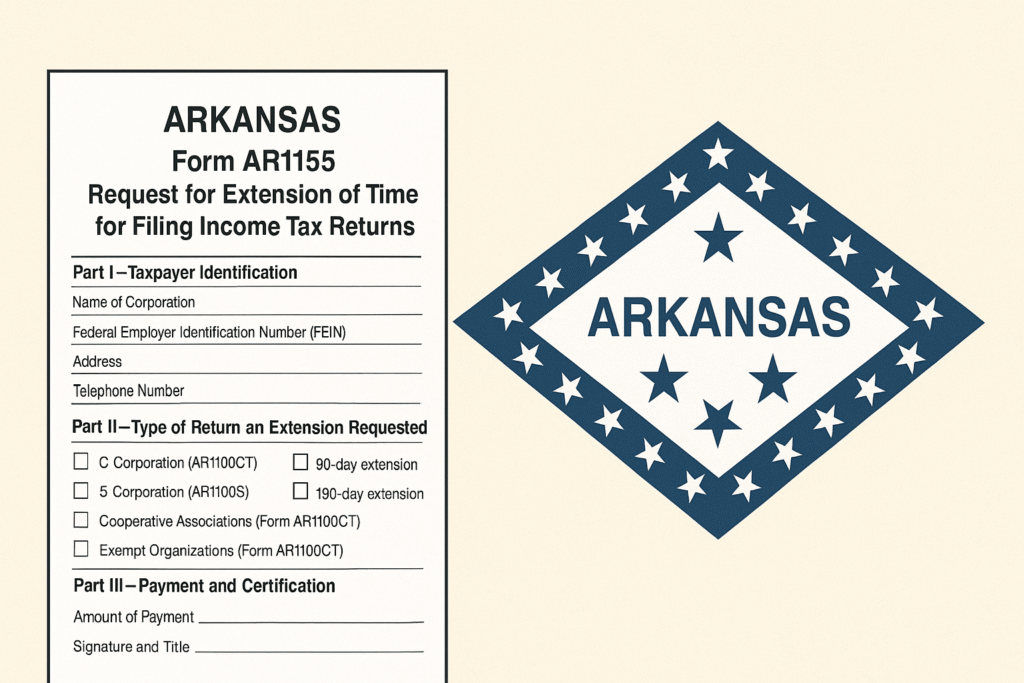

How to Complete Form AR1155 – Line-by-Line Instructions

Form AR1155 is relatively short, but accuracy is essential. Each section must be completed correctly to avoid processing delays or denial.

At the top of the form, enter the tax year beginning and ending dates (for example, January 1, 2024 – December 31, 2024). This identifies the return period you are extending.

Part I – Taxpayer Identification

- Name of Corporation: Enter the exact legal name of the business as it appears on the Arkansas income tax return.

- Federal Employer Identification Number (FEIN): Provide your FEIN issued by the IRS.

- Address: Include your complete mailing address — street, city, state, and ZIP code.

- Telephone Number: Provide a valid contact number for follow-up, if needed.

Part II – Type of Return and Extension Requested

This section determines what kind of return you are extending and the length of time requested.

- Type of Return:

- Check the box for either C Corporation (AR1100CT) or S Corporation (AR1100S) or Cooperative Associations (Form AR1100CT) or Exempt Organizations (Form AR1100CT).

- Extension Period Requested:

- 60-Day Extension: Check this if you already have a valid federal extension and want 60 additional days for your Arkansas filing.

- 180-Day Extension: Check this if you are requesting an Arkansas-only extension and did not file a federal extension.

- Tax Year:

- Enter your beginning and ending dates for the tax year being extended.

Part III – Payment and Certification

This part addresses estimated tax payments and certification of accuracy.

- Amount of Payment:

- Enter the estimated tax amount due, if any. This payment should accompany the form.

- Even with an extension, taxes owed must be paid by the original due date.

- If you expect a refund or zero balance, you may enter “0.”

- Due Date of Return:

- Enter the original due date (e.g., April 15, 2025).

- Signature and Title:

- The form must be signed by an authorized officer of the corporation (e.g., President, CFO, or Treasurer).

- Include the title and date signed. Unsigned forms are not valid.

Important Notes:

- Extensions apply to filing only, not payment. Any tax due must be paid by the original due date.

- Inability to pay is not a valid reason for requesting an extension.

- The Arkansas DFA reserves the right to deny extensions filed late or incomplete.

- Interest and penalties apply to unpaid balances even if the extension is approved.

Where to Mail Form AR1155

Mail the completed form, along with any tax payment or voucher, to:

Corporation Income Tax SectionP.O. Box 919

Little Rock, AR 72203-0919

Make sure the envelope is postmarked on or before the due date. Use certified mail or another trackable method to confirm timely filing.

Frequently Asked Questions (FAQs)

No. The form only extends the time to file your return. You must pay any taxes owed by the original due date to avoid interest and penalties.

Not necessarily. Arkansas automatically honors a valid federal extension. File AR1155 only if you need extra state-only time beyond the federal extension.

Late extension requests are typically denied. The return will be considered late, and penalties and interest will apply.

No. Partnerships and fiduciaries must use their respective extension forms (such as AR1055-PE). Form AR1155 is specifically for corporate income tax returns.

You can request up to 180 days (six months) for a full Arkansas extension or 60 additional days beyond a valid federal extension.

Yes, if you expect to owe tax. Payments made with the extension request are applied toward your total tax liability when you file your return.

Final Thoughts

Filing Arkansas Form AR1155 is a straightforward but critical step for corporations and S corporations that cannot meet the original filing deadline. It ensures compliance with state filing requirements and avoids the costly penalties of late submission.

However, remember that this extension covers filing only — not payment. Always calculate and pay any estimated tax owed by the original due date, even if you are requesting an extension.

For best results:

- File early to avoid delays.

- Ensure accuracy when completing identification and payment details.

- Keep a copy of your approved extension for your records and attach it to your tax return when filed.

By understanding and properly using Form AR1155, Arkansas businesses can stay compliant, reduce late-filing risks, and manage their corporate tax obligations efficiently.