Distributions from qualified retirement plans, annuities, IRAs, and similar arrangements are reported on IRS Form 1099‑R. Whether you’re an employer, plan administrator, or payer, understanding Form 1099‑R’s requirements is essential to ensure accurate reporting of retirement income, avoid penalties, and help recipients properly prepare their tax returns.

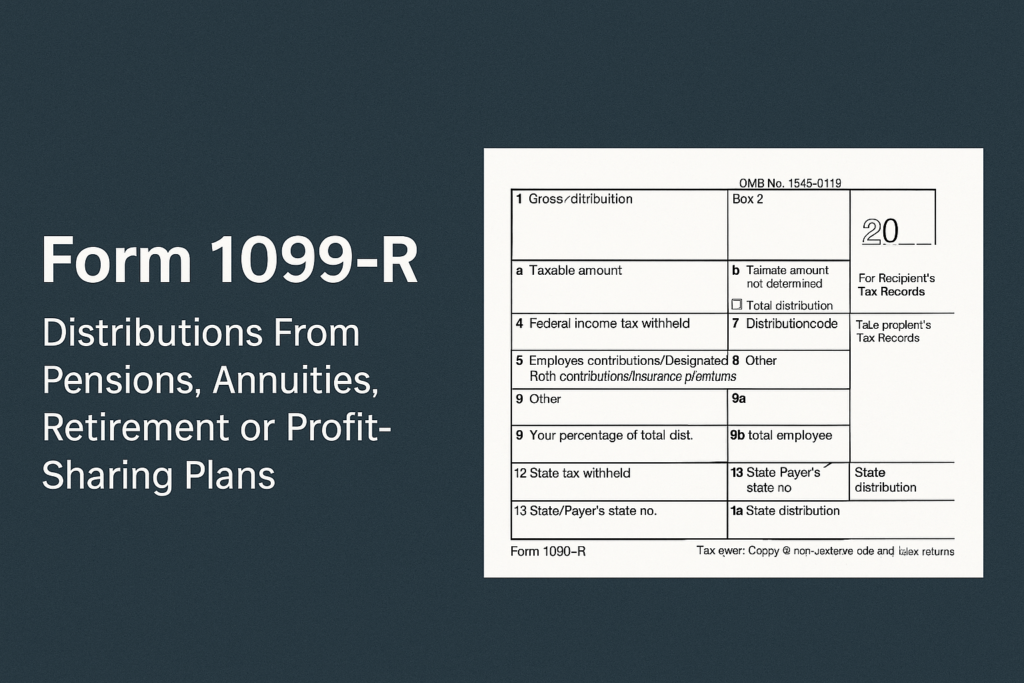

What Is Form 1099‑R: Distributions From Pensions, Annuities, Retirement or Profit‑Sharing Plans?

Form 1099‑R is used to report distributions—including retirement, pension, annuity, profit‑sharing, IRA, insurance contract, and other deferred compensation distributions—to beneficiaries and the IRS.

- Who issues it? Payers such as plan administrators, insurance companies, employers, or trustees.

- Who receives it? Any individual or entity that received a distribution of $10 or more during the calendar year.

- Primary purpose: To document taxable and non‑taxable portions of distributions and applicable federal income tax withheld.

Who Can File Form 1099‑R?

You must file Form 1099‑R if, in the course of your trade or business, you:

- Make distributions of $10 or more from pension, annuity, retirement, or profit‑sharing plans.

- Distribute funds from an IRA, SEP, SIMPLE, or other retirement arrangements.

- Issue death‑benefit payments from a plan.

- Provide nonqualified deferred compensation distributions.

Entities required to file include corporations, partnerships, LLCs, tax‑exempt organizations, and government entities acting as plan administrators.

When Is the Deadline to File Form 1099‑R?

- Recipient Copy (Copy B): Must be furnished to recipients by January 31 of the year following the distribution.

- IRS Copy (Copy A): Must be filed by February 28 if filing by paper; by March 31 if filing electronically.

- State copies: Deadlines vary by state—check local requirements.

Missing or late filings can incur significant penalties, escalating with the length of the delay.

How to Complete Form 1099‑R – Box by Box

- Box 1 – Gross Distribution: Total amount distributed before withholding.

- Box 2a – Taxable Amount: Portion subject to federal income tax.

- Box 2b – Taxable Amount Not Determined/Total Distribution Checkboxes: Mark if payer can’t determine taxable part or if entire distribution.

- Box 4 – Federal Income Tax Withheld: Amount withheld under backup withholding or voluntary withholding elections.

- Box 5 – Employee Contributions/Designated Roth Contributions/Insurance Premiums: After‑tax contributions or Roth basis.

- Box 7 – Distribution Code(s): Indicates type of distribution (see next section). Multiple codes may apply.

- Box 8 – Other: State‑required codes.

- Box 9a / 9b – Your Percentage of Pension Plan Liability / Total Employee Contributions: Generally left blank; for certain nonqualified plans.

- Box 12 – State Tax Withheld: Amount withheld for state income tax.

- Boxes 13–14 – State/Payer’s State No. and State Distribution: For state reporting.

New Changes for 2025

- Box 7 additions: Three new distribution codes have been introduced to clarify specific transaction types:

- Y4 – Qualified birth or adoption distribution (up to $5,000 penalty‑free).

- Y7 – Coronavirus-related distribution repaid in same year (for CARES‑type distributions).

- YK – Repayment of qualified reservist distribution.

- Form layout tweaks: Slight repositioning of the contributions box and updated instructions to reflect these new codes.

What Are the Distribution Codes for Form 1099‑R?

Distribution codes in Box 7 characterize the nature of each distribution. Common codes include:

- 1 – Early distribution, no known exception (subject to penalty).

- 2 – Early distribution, exception applies (e.g., first‑time homebuyer, disability).

- 3 – Disability.

- 4 – Death.

- 7 – Normal distribution (age‑59½ or older).

- G – Direct rollover to a qualified plan or IRA.

- J – Early distribution from a Roth IRA.

- Y4 / Y7 / YK – New for 2025 (see “New Changes for 2025” above).

A full list and definitions are in the Form 1099‑R instructions.

How to File Form 1099‑R

- Gather data: Compile distribution amounts, withholding information, payer and recipient details, and correct distribution codes.

- Complete copies:

- Copy A to IRS (with Form 1096 if filing by paper).

- Copy B to recipient.

- Copy C for payer records.

- Choose filing method:

- Electronic: Via IRS FIRE system. Required if filing ≥250 forms (threshold may lower).

- Paper: On official red‑ink forms.

- Submit on time: Ensure recipient copies go by January 31; IRS copies by February 28 (paper) or March 31 (electronic).

What Are the Penalties for Not Filing Form 1099‑R?

Penalties depend on how late the form is filed and size of business:

- $50 per form if filed within 30 days of deadline (max $588,500 per year).

- $110 per form if filed after 30 days but by August 1.

- $290 per form if filed after August 1 or not filed at all (max $1,766,000 per year).

Intentional disregard of filing requirements raises the penalty to at least $580 per form, with no maximum cap.

Extension to File 1099‑R

To request more time for furnishing recipient copies or filing with the IRS, submit Form 8809, Application for Extension of Time to File Information Returns, by the original due date.

- Grants an automatic 30‑day extension; additional 30 days may be granted if requested before the first extension expires.

- Note: Form 8809 cannot extend the January 31 recipient furnishing deadline.

What Recipients Do with Form 1099‑R

When taxpayers receive Form 1099‑R, they should:

- Verify accuracy: Check distribution amounts, withholding, and codes.

- Report on tax return:

- Box 1 & 2a flow to Form 1040 lines for pensions and annuities or IRAs.

- Code G rollovers generally aren’t taxable if timely.

- Attach additional forms: If rollovers or special distributions apply (e.g., Form 8606 for nondeductible IRA basis).

- Keep for records: Retain in case of IRS inquiry or audit.

A clear understanding of Form 1099‑R helps both payers and recipients stay compliant, minimize surprises at tax time, and take advantage of any exceptions or relief provisions.

Final Thoughts

Form 1099-R is essential for reporting retirement-related distributions. Whether you’re filing the form or receiving it, understanding its purpose and how each box works ensures smooth tax reporting. With updates like the new 2025 distribution codes, staying informed helps avoid errors and penalties.

Clear, timely filing benefits both payers and recipients—and keeps tax season stress-free.