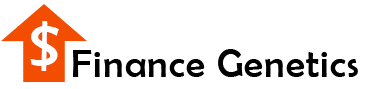

As a financial institution, business, or government agency, issuing accurate tax forms is a crucial part of your year-end compliance responsibilities. One such form is IRS Form 1099-INT, used to report interest income paid to individuals or entities.

This guide explains everything you need to know about Form 1099-INT—from understanding interest income and who must file, to completing the form box by box, meeting deadlines, avoiding penalties, and guiding recipients.

What Is Form 1099-INT?

Form 1099-INT (Interest Income) is an IRS information return used to report interest payments made to taxpayers. If you paid $10 or more in interest during the tax year, you’re generally required to file this form with the IRS and provide a copy to the recipient.

It ensures interest income is properly reported and taxed, especially when not captured through wages or traditional payroll.

What Is Interest Income?

Interest income refers to earnings from deposits, loans, or investments that pay interest. Common sources include:

- Savings and checking accounts

- Certificates of deposit (CDs)

- U.S. Treasury securities

- Municipal or corporate bonds

- Seller-financed mortgages

- Investment accounts

Most interest income is taxable at the federal level, unless specifically excluded (such as some municipal bond interest).

Who Must File Form 1099-INT?

You must file Form 1099-INT if, during your business or agency operations, you paid:

$10 or more in interest to an individual, partnership, or non-corporate entity

Any amount if federal income tax was withheld (e.g., backup withholding)

Typical filers include:

- Banks and credit unions

- Government agencies (state, federal, or local)

- Investment firms and brokers

- Mutual funds

- Individuals or businesses involved in seller-financed loans

Related article: What Is Form 1099-NEC? Nonemployee Compensation Filing Guide

When Is the Deadline to File Form 1099-INT?

Here are the deadlines for the 2024 tax year:

- Recipient Copy (Copy B): Due January 31

- IRS Filing by Paper: Due February 28

- IRS Filing Electronically: Due March 31

Important: If you’re filing 10 or more 1099 forms, you must file electronically using the IRS IRIS portal.

Copies of Form 1099-INT: What Each One Is For

Form 1099-INT comes with multiple copies, each designated for a specific recipient or agency. Here’s a breakdown of each:

Copy A – For IRS

Filed with the IRS. If filing by paper, must be accompanied by Form 1096.

Copy 1 – For State Tax Department (if applicable)

Sent to the state tax department if required by that state.

Check with your state for filing requirements.

Copy B – For Recipient

Provided to the person or entity receiving the interest income.

They use this to file their federal income tax return.

Copy 2 – For Recipient’s State Tax Return

Used by the recipient to file with their state income tax return, if applicable.

Copy C – For Payer’s Records

Retained by you, the payer, for at least 4 years.

Useful for recordkeeping and responding to IRS inquiries or audits.

Note: Only Copy A should be submitted to the IRS. Do not print and mail the IRS PDF version; use preprinted forms or file electronically through IRS-approved channels.

How to Complete Form 1099-INT (Box-by-Box)

Each box reports a specific type of interest or detail. Here’s a clear explanation for each:

Box 1 – Interest Income

Taxable interest paid during the year. This includes interest from bank accounts, CDs, and certain bonds.

Box 2 – Early Withdrawal Penalty

Penalties you charged for early withdrawal from a time deposit (e.g., CD). Recipients can deduct this.

Box 3 – Interest on U.S. Savings Bonds and Treasury Obligations

Interest from Treasury notes, bonds, or savings bonds. Taxable federally, but usually state-exempt.

Box 4 – Federal Income Tax Withheld

Report any backup withholding due to an incorrect or missing TIN.

Box 5 – Investment Expenses

Used for single-class REMICs. Most payers will leave this box blank.

Box 6 – Foreign Tax Paid

Enter foreign tax withheld, if applicable, on foreign-source interest.

Box 7 – Foreign Country or U.S. Possession

The name of the country for which foreign tax in Box 6 was paid.

Box 8 – Tax-Exempt Interest

Interest income that is federally tax-exempt, such as from municipal bonds.

Box 9 – Specified Private Activity Bond Interest

Tax-exempt interest from private activity bonds, which may be subject to the AMT.

Box 10 – Market Discount

If applicable, report any accrued market discount on bonds bought below face value.

Box 11 – Bond Premium

Report bond premiums that reduce the interest income in Box 1.

Box 12 – Bond Premium on Treasury Obligations

Used to offset interest income in Box 3 from bond premiums on Treasury securities.

Box 13 – Bond Premium on Tax-Exempt Bonds

Reduces tax-exempt interest reported in Box 8 due to premiums paid.

Box 14 – Tax-Exempt and Tax Credit Bond CUSIP Number

Enter the CUSIP number identifying the bond reported in Boxes 8 or 9.

Box 15 – State

Name of the state for which state tax is being reported.

Box 16 – State Identification Number

Your payer ID assigned by the state.

Box 17 – State Tax Withheld

Amount of state tax withheld from the recipient’s interest income.

How to File Form 1099-INT

You must file with the IRS and furnish a copy to each recipient. Here’s how:

1. Paper Filing

Submit Copy A to the IRS with Form 1096

Mail by February 28, 2025

2. Electronic Filing

File through the IRS IRIS system

Mandatory if filing 10 or more forms

3. Provide Copy B to Recipient

Deliver by January 31, 2025, either by mail or electronically with recipient consent

4. Retain Copy C

Keep for at least 4 years

Penalties for Not Filing Form 1099-INT

Not filing, filing late, or submitting incorrect forms can lead to penalties:

| Filing Delay | Penalty per Form | Max for Small Businesses |

| ≤ 30 days late | $60 | $220,500 |

| 31 days to August 1 | $120 | $630,500 |

| After August 1 or not filed | $310 | $1,261,000 |

| Intentional disregard | $630 | No limit |

Penalties apply per return, including for missing or incorrect recipient copies.

Extension to File or Furnish Form 1099-INT

You may need more time to meet deadlines. Here’s how:

To extend IRS filing deadline:

- File Form 8809 before the due date

- Grants a 30-day automatic extension

To extend recipient copy deadline:

- If you need more time to provide recipient copies, use Form 15397, Application for Extension of Time to Furnish Recipient Statements. It gives a 30-day extension for delivering Copy B.

Who Is Exempt from Filing Form 1099-INT?

You do not have to file Form 1099-INT if:

- Interest paid is less than $10

- Interest was paid to a corporation (with some exceptions)

- Payments were made to tax-exempt organizations, IRAs, or government entities

- Interest was paid to foreign persons (report using Form 1042-S instead)

What Should Recipients Do with Form 1099-INT?

If you issue Form 1099-INT, the recipient should:

- Review for accuracy and completeness

- Report interest income on their Form 1040

- If total interest exceeds $1,500, use Schedule B

- Report tax-exempt income separately (even though it’s not taxed)

- Contact you if they spot errors

Final Thoughts

Form 1099-INT is a crucial part of annual tax reporting for any business or institution that pays interest. By understanding your obligations—what to report, how to file, and when to do it—you can stay compliant and avoid penalties. Start preparing early, verify TINs, and keep clear records so you’re ready when filing season arrives.