Managing employment taxes can be a challenging but essential part of running a business. One of the critical obligations for employers in the United States is filing IRS Form 940, which covers federal unemployment taxes. Alongside Form 940, employers also handle other key filings such as Form 941 and Form 944, which report different types of employment taxes. While this may not get as much attention as quarterly filings, staying compliant with its requirements is just as important. This guide breaks down what Form 940 is, who needs to file it, how to complete it correctly, and what to expect if deadlines are missed.

What Is Form 940?

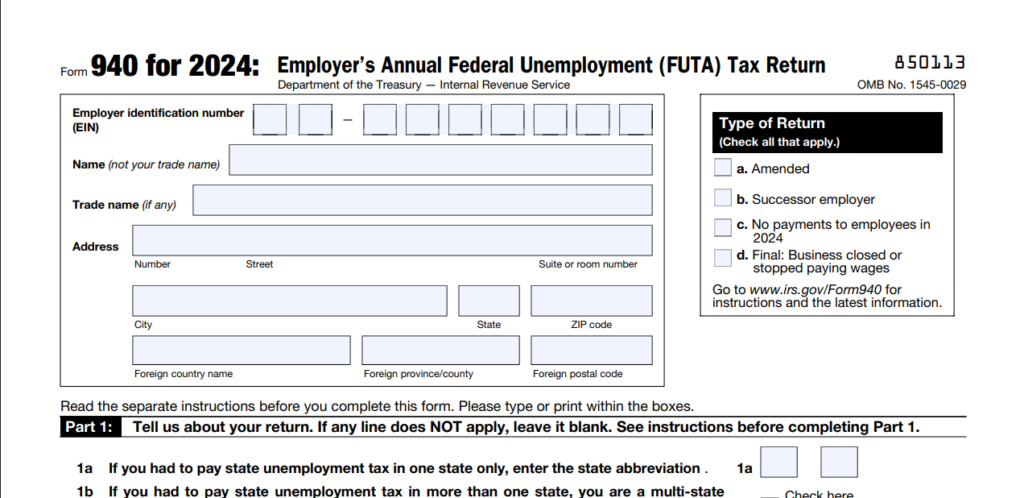

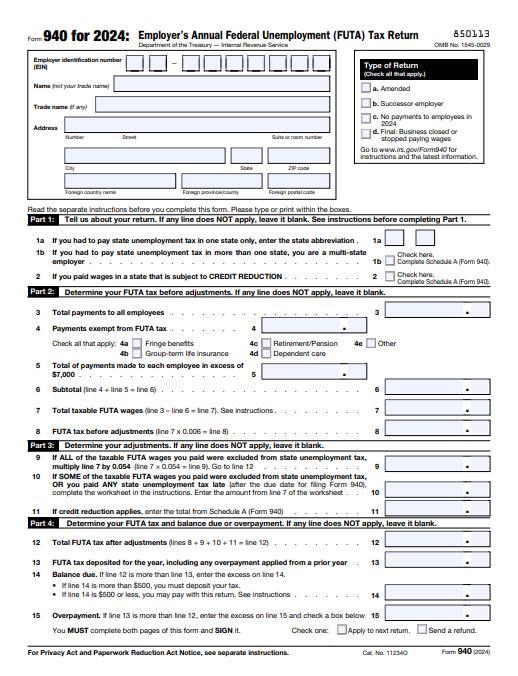

Form 940 is an annual federal tax form that employers use to report their Federal Unemployment Tax Act (FUTA) liabilities to the IRS. Unlike other employment taxes, FUTA taxes are solely paid by employers and are not withheld from employee wages. The funds support unemployment compensation to workers who have lost their jobs.

Who Must File Form 940?

Most businesses that paid $1,500 or more in wages in any calendar quarter, or had at least one employee working for any part of 20 or more different weeks, are required to file Form 940.

This includes:

- Employers with part-time or full-time workers

- Seasonal employers if they meet wage or employee thresholds

- Household employers (in specific cases)

If a business had no FUTA liability during the year but met the employee or wage requirements, it must still file a zero return.

2025 Draft Update: IRS Form 940 Adds New Features

On June 26, 2025, the IRS released a draft version of Form 940 for the upcoming filing season, introducing a few notable changes aimed at improving transparency and refund processing:

New Checkbox for Aggregate Filers

A key addition in the draft is a new checkbox that allows filers to identify their role if they are filing on behalf of multiple employers. Specifically, it helps distinguish:

- Certified Professional Employer Organizations (CPEOs)

- Section 3504 Agents (acting as agents under IRS regulations)

- Other Third Parties

This change enhances clarity in tax filings involving third-party agents or organizations.

Banking Information for Refunds (Part 4 Additions)

The IRS has also updated Part 4 of Form 940, adding new lines 15b through 15e. These lines now give employers the ability to provide their direct deposit banking information when they are requesting a refund for overpaid FUTA taxes.

While the current version of Form 940 allows for refund claims, it did not include a space for employers to specify their bank account details. With this draft revision, the process for refunding overpayments is expected to become faster and more streamlined.

You can view the official draft form on the IRS website:

Who Is Exempt from Filing 940?

Some employers are exempt from filing Form 940, including:

- Nonprofit organizations that are 501(c)(3) tax-exempt

- State and local government employers

- Indian tribal governments (in certain cases)

These employers are generally exempt from FUTA tax and are not required to file “940 form” unless they have specific arrangements or circumstances that subject them to FUTA.

When Is the Deadline to file 940?

Form 940 is due by January 31 following the end of the tax year. For example, for 2025 wages, the filing deadline is January 31, 2026. However, if all FUTA tax due has been deposited on time, employers get an extended deadline until February 10.

Information Required to File Form 940

To complete Form 940, businesses need:

- Employer Identification Number (EIN)

- Total employee wages paid during the year

- Amounts exempt from FUTA (e.g., fringe benefits, group term life insurance, etc.)

- State unemployment (SUTA) tax payments made

FUTA tax already deposited during the year

How to Complete Form 940

Form 940 is fairly straightforward compared to quarterly payroll forms. Here’s a breakdown of the main sections:

- Business Information: EIN, name, and address

- FUTA Wage Base Calculation: Start with total wages, subtract exempt wages, and apply the tax rate to the first $7,000 per employee

- Adjustments: Apply state tax credits or reductions

- Tax Liability: Calculate any overpayment or balance due

- Quarterly Breakdown: Required if FUTA tax exceeds $500

- Refund or Credit Selection: Indicate whether to apply an overpayment to the next return or request a refund

- Signature: Authorized individual must sign the form

If operating in more than one state or a credit reduction state, Schedule A must be attached.

FUTA vs. SUTA: What’s the Difference?

- FUTA (Federal): Paid to the IRS, supports national unemployment funds

- SUTA (State): Paid to state unemployment programs, rates vary by state and employer history

Employers can claim a credit of up to 5.4% on their FUTA taxes if they paid state unemployment taxes on time, reducing the standard FUTA tax rate of 6.0% to 0.6%.

Credit Reduction States

Some states borrow from the federal government to pay unemployment benefits. If they fail to repay on time, they are classified as credit reduction states. Employers in these states receive a lower FUTA credit, which increases their effective tax rate. The IRS publishes a list of these states annually.

FUTA Tax Rates for 2025 and 2026

- Standard Rate: 6.0% on the first $7,000 of each employee’s wages

- Typical Net Rate: 0.6% (if full SUTA credit is applied)

This means employers typically pay up to $42 per employee per year unless in a credit reduction state.

How to File Form 940

It can be filed by paper or electronically, depending on the business’s preference.

Electronic Filing

- Done through IRS-approved tax software or a tax professional

- Faster processing and quicker refunds if overpaid

Paper Filing

- Mailed to the IRS address listed in the form instructions

- Recommended to send via certified mail with proof of delivery

Note: This can be filed by paper or electronically, giving business owners flexibility based on their resources and preferences.

Penalties for Not Filing

Failure to file Form 940 or pay FUTA taxes on time can result in:

- Late filing penalties: 5% of the tax due per month (up to 25%)

- Late payment penalties: 0.5% of the unpaid tax per month

- Interest charges on any unpaid balance

To avoid penalties, ensure:

- Timely deposits of FUTA taxes (usually quarterly if over $500)

- On-time and accurate filing

Form 940 vs. Form 941 vs. Form 944

Understanding the differences:

- Form 940: Annual filing for FUTA tax (employer-paid)

- Form 941: Quarterly filing for income tax withheld and Social Security/Medicare taxes

- Form 944: Annual version of Form 941 for small employers (if approved by IRS)

Form 940 only reports federal unemployment tax, while Form 941/944 covers payroll taxes withheld from employee wages.

Final Thoughts

Staying compliant with employment tax requirements like Form 940 is essential for every business owner. While FUTA tax may seem minor compared to other payroll obligations, accurate and timely filing helps avoid penalties and ensures that unemployment systems remain properly funded. By understanding who must file, exemptions, the key deadlines, and how FUTA interacts with SUTA and other employment tax forms like 941 and 944, employers can confidently handle their year-end responsibilities. Whether filing by paper or electronically, planning ahead and keeping records organized will make tax season smoother and stress-free.