For individuals with disabilities and their families, managing savings while maintaining eligibility for critical federal benefits can be a challenge. Achieving a Better Life Experience (ABLE) accounts were created to solve this problem by providing a tax-advantaged way to save for disability-related expenses without jeopardizing programs such as Medicaid or Supplemental Security Income (SSI).

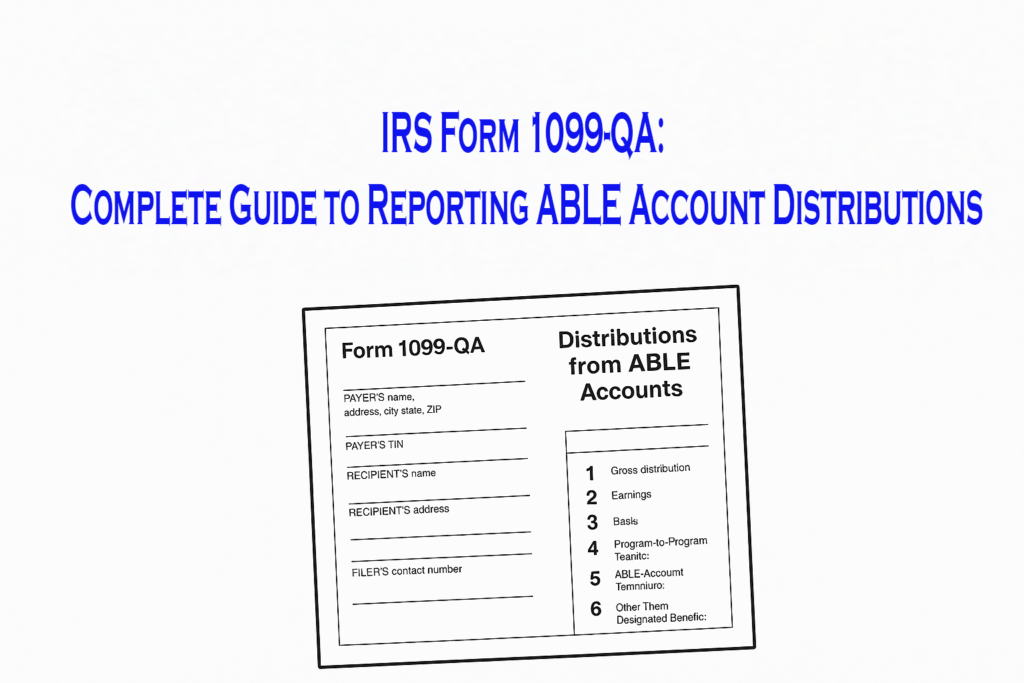

Like other tax-advantaged accounts, ABLE accounts have IRS reporting requirements. One of the key forms used in this process is Form 1099-QA, Distributions from ABLE Accounts.

Whether you are a program administrator, a beneficiary, or a tax professional, understanding this form is essential to staying compliant and avoiding costly mistakes. This guide covers everything you need to know — from who files it, to deadlines, to step-by-step instructions for completion.

What is Form 1099-QA?

Form 1099-QA is an IRS information return used to report distributions from ABLE accounts during the tax year. The form details:

- Gross distribution amount (total withdrawn)

- Earnings portion (which may be taxable if not used for qualified disability expenses)

- Basis portion (contributions)

- Special categories such as rollovers, account terminations, and distributions to someone other than the beneficiary

The form is not used to report contributions into the ABLE account only amounts taken out.

What is an ABLE Account?

An ABLE account is a tax-advantaged savings program established under Section 529A of the Internal Revenue Code. It is designed for individuals whose disability began before age 26 (increasing to age 46 starting in 2026 under SECURE 2.0).

Key benefits of an ABLE account include:

- Tax-free growth on earnings when funds are used for qualified disability expenses (QDEs).

- No impact on Medicaid eligibility and limited effect on SSI benefits.

- Flexible usage for a broad range of disability-related expenses, including:

- Housing

- Education and training

- Assistive technology

- Transportation

- Healthcare and therapy

- Legal fees and financial management

Funds can come from the beneficiary, family, friends, or other sources, but annual contribution limits apply (aligned with the annual gift tax exclusion, plus certain employment-related contributions under ABLE to Work provisions).

Who Must File Form 1099-QA?

The responsibility to file lies with the state agency, state instrumentality, or program administrator that operates the ABLE account.

A separate Form 1099-QA must be filed for each account in any of the following situations:

- Any distribution during the year.

- Rollover to another ABLE program in a different state.

- Termination of the ABLE account.

- Distribution to a person other than the designated beneficiary.

Even if the distribution is small or the account was active only part of the year, the form must still be filed.

Who Will Receive Form 1099-QA?

The recipient of Form 1099-QA depends on who actually received the funds:

- Designated Beneficiary – If the withdrawal is made directly for their benefit.

- Contributor – If the withdrawal is a return of excess contributions (plus earnings).

- Other Payee – If the distribution goes to an estate or other party after the beneficiary’s death.

Difference Between Form 5498-QA and Form 1099-QA

ABLE accounts involve both contributions and distributions, and the IRS uses two separate forms to track these activities. Form 5498-QA reports contributions and account details, while Form 1099-QA reports withdrawals and distributions. Understanding the difference between these forms is important for accurate tax reporting and compliance.

| Aspect | Form 5498-QA | Form 1099-QA |

| Purpose | Reports contributions, rollovers, and certain account details for an ABLE account. | Reports distributions (withdrawals) from an ABLE account. |

| Focus | Money going into the ABLE account. | Money coming out of the ABLE account. |

| Issued By | ABLE program or account administrator. | ABLE program or account administrator. |

| Recipient | Beneficiary and IRS. | Beneficiary and IRS. |

| Key Information | Annual contributions, rollovers, account start date, disability certification. | Total distribution, earnings portion, basis portion, death of account owner. |

| When Sent to Recipient | By May 31 of the following year. | By January 31 of the following year. |

| Tax Impact | Helps confirm contribution limits are not exceeded. | Determines whether distributions are taxable. |

When is the Deadline to File Form 1099-QA?

The IRS sets specific deadlines each year for filing Form 1099-QA and providing copies to recipients. Meeting these dates is essential to avoid penalties and ensure accurate tax reporting.

The deadlines are:

- To Recipients: January 31 of the year following the distribution year.

- To the IRS:

- February 28 if filing on paper.

- March 31 if filing electronically.

Information Required to File Form 1099-QA

Before preparing the form, the payer must have the following details ready:

- Payer’s legal name.

- Payer’s mailing address.

- Payer’s Taxpayer Identification Number (TIN).

- Recipient’s legal name.

- Recipient’s mailing address.

- Recipient’s TIN.

- ABLE account number (if applicable for tracking).

- Total gross distributions during the year.

- Earnings portion of those distributions.

- Basis amount (contribution portion).

- Distribution category (standard withdrawal, rollover, account termination, or other).

How to Complete Form 1099-QA – Line-by-Line Instructions

Filling out Form 1099-QA correctly ensures that ABLE account distributions are reported accurately to both the IRS and the recipient. The form is divided into several boxes, each requiring specific information.

- Payer’s Name, Address, and TIN

- Enter the full legal name of the ABLE program administrator.

- Provide a complete mailing address.

- Enter the payer’s TIN in the designated box.

- Recipient’s Name, Address, and TIN

- Enter the legal name of the designated beneficiary or other payee.

- Provide their complete mailing address.

- Enter their TIN (usually an SSN).

- Account Number

- Include if the payer manages multiple accounts for the same recipient.

- Box 1 – Gross Distribution

- Report the total amount distributed from the account during the year.

- Box 2 – Earnings

- Enter the portion of the gross distribution representing investment earnings.

- Box 3 – Basis

- Report the portion of the gross distribution that represents contributions.

- Box 4 – Program-to-Program Transfer

- Check if the distribution was a direct transfer to another ABLE program for the same beneficiary.

- Box 5 – ABLE Account Terminated

- Check if the account was closed during the year.

- Box 6 – Other Than Designated Beneficiary

- Check if the distribution was made to someone other than the beneficiary.

- Filer’s Contact Number

- Provide a telephone number for IRS or recipient inquiries.

- Distribute Copies

- Send Copy A to the IRS with Form 1096 (if paper filing).

- Send Copy B to the recipient by January 31.

- Retain Copy C for at least four years.

Copies of Form 1099-QA

Form 1099-QA comes in multiple copies, each serving a different purpose. These copies ensure that the IRS, the recipient, and the filer all have the necessary records for tax reporting.

- Copy A – Sent to IRS.

- Copy B – Sent to recipient.

- Copy C – Kept by payer.

How to File Form 1099-QA

Once Form 1099-QA is completed, it must be filed with the IRS and a copy provided to the recipient. The IRS offers both electronic and paper filing options, each with its own requirements.

Electronic Filing – Required for most filers submitting 10 or more information returns in total for the year. Recommended for accuracy and efficiency.

Paper Filing – Must use the official red-ink scannable form. Send Copy A with Form 1096 to the IRS address listed in the current General Instructions for Certain Information Returns.

Where to Mail Form 1099-QA

Paper filers must mail the form to the correct IRS processing center based on the payer’s location.

| If your business operates in or your legal residence is | Mail Form 1099-QA to |

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue ServiceAustin Submission Processing CenterP.O. Box 149213Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the TreasuryIRS Submission Processing CenterP.O. Box 219256Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the TreasuryIRS Submission Processing Center1973 North Rulon White Blvd.Ogden, UT 84201 |

What Are the Penalties for Not Filing Form 1099-QA?

Failure to file correct and timely forms may result in penalties:

- $60 per form if filed within 30 days after the due date (max $630,500/year)

- $120 per form if filed more than 30 days late but before August 1 (max $1,891,500/year)

- $310 per form if filed after August 1 or not filed at all (max $3,783,000/year)

Intentional disregard of filing requirements results in $630 per form with no maximum limit.

Exceptions to Filing Form 1099-QA

- Are there situations where Form 1099-QA is not required?

Yes. If no distributions are made from an ABLE account during the tax year, Form 1099-QA does not need to be filed. - Is Form 1099-QA required for contributions?

No. Contributions are reported on Form 5498-QA, not on Form 1099-QA. - What about rollovers or internal transfers?

Direct rollovers between ABLE accounts for the same beneficiary or an eligible family member generally do not require Form 1099-QA if they follow IRS rules. - Does closing an account always require filing?

No. If the account is closed without any distributions, the form is not required. However, if a distribution is part of the closure, Form 1099-QA must be filed.

What Recipients Should Do with Form 1099-QA

- Check for Accuracy – Review all amounts and personal details.

- Determine Tax Impact – If used for qualified disability expenses, earnings are tax-free; otherwise, earnings may be taxable plus subject to a 10% penalty.

- Report if Required – Include taxable amounts on your federal return.

- Keep Records – Maintain receipts and records for at least three years.

Conclusion

Form 1099-QA ensures transparency and compliance for ABLE account distributions. For administrators, timely and accurate filing is a legal requirement that avoids penalties. For recipients, understanding the form safeguards the tax benefits of ABLE accounts and prevents unnecessary tax liabilities.

By keeping organized records, knowing the deadlines, and following the IRS instructions line-by-line, both payers and recipients can handle Form 1099-QA with confidence.