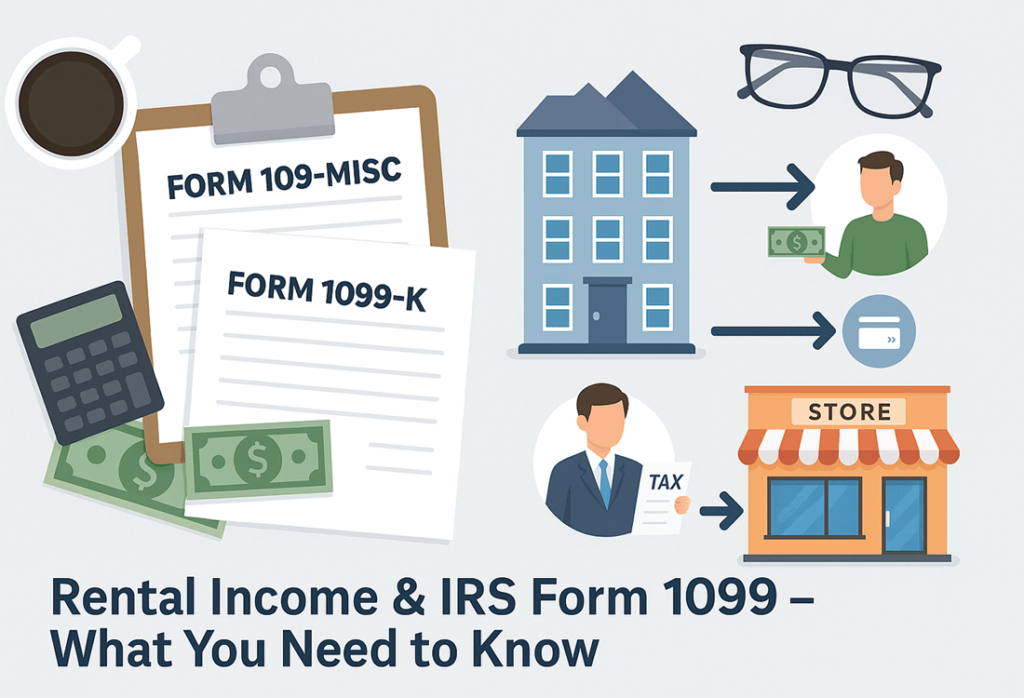

Rental income can be a lucrative source of revenue, but it comes with tax responsibilities. One of the most important reporting requirements for landlords, property managers, and even commercial tenants is understanding how and when to report rental payments using IRS Form 1099.

If you’re wondering whether you need to issue or receive a 1099 for rental income, this guide breaks down every aspect—from what qualifies as rental income to which IRS forms apply and who is required (or exempt) from filing.

Rental Income – An Overview

Rental income is any payment received by a property owner or landlord for the use or occupation of property. This includes income from residential, commercial, and vacation rentals. It doesn’t stop at just monthly rent payments—advance rent, lease cancellation fees, and even expenses paid by tenants can all qualify as taxable rental income.

Rental income must be reported on your tax return for the year in which it is received. This applies whether you are an individual landlord, a business entity, or a property management company.

What Types of Income Are Considered Rental Income?

The IRS has a broad definition of rental income, which includes:

- Monthly Rent Payments: Regular payments made by tenants for occupying the property.

- Advance Rent: Rent paid in advance, regardless of the period it covers.

- Security Deposits Retained: If the deposit is kept due to lease violations or damages, it becomes income.

- Lease Cancellation Fees: Payments from tenants to terminate the lease early.

- Expenses Paid by Tenant: If a tenant pays for services or repairs that are your responsibility (e.g., plumbing), the amount is considered rental income.

- Barter Transactions: If a tenant provides goods or services instead of cash rent, the fair market value of those goods/services is considered income.

Example:

If a tenant pays $2,000 in rent and covers a $500 plumbing bill that was your responsibility, you must report $2,500 as rental income.

How is Rental Income Taxed for Landlords and Property Managers?

Rental income is typically taxed as ordinary income and must be reported on Schedule E (Form 1040) for individual taxpayers. Property managers and businesses may report this under corporate or partnership returns depending on their entity structure.

While rental income is taxable, landlords can offset it with allowable deductions, such as:

- Mortgage interest

- Property taxes

- Depreciation

- Repairs and maintenance

- Insurance premiums

- Management fees

- Utilities (if paid by landlord)

This means only the net rental income—after expenses—is subject to tax.

Who Is Subject to 1099 Rental Income Reporting?

Not everyone who earns or pays rent must file a 1099. However, the following individuals and businesses are required to issue Form 1099 for rental payments:

- Businesses (not individuals) that pay $600 or more per year in rent to a landlord.

- Property managers paying vendors (plumbers, electricians, etc.) $600 or more in a calendar year.

- Landlords receiving payments through third-party networks, like Airbnb or credit card processors.

Commercial tenants must report payments of $600 or more per year made to landlords using Form 1099-MISC.

Which 1099 Forms Are Used to Report Rental Income?

There are two key IRS forms used to report rental-related payments: Form 1099-MISC and Form 1099-K. The form you need depends on how the payment was made and who is paying.

Form 1099-MISC

Form 1099-MISC is used to report rent payments of $600 or more in a year made in the course of a trade or business.

Where to report rental payments:

Rental payments are reported in Box 1 – Rents of Form 1099-MISC.

Key Rental Use Case:

If you’re a commercial tenant paying $600 or more per year in rent to your landlord, you must file Form 1099-MISC to report that payment.

Note: Non-commercial (residential) tenants are not required to file Form 1099-MISC.

Example:

A retail business rents a storefront for $1,500 per month. At the end of the year, the business files Form 1099-MISC and reports $18,000 in Box 1 (Rents).

Form 1099-K

Form 1099-K is issued by payment settlement entities (PSEs) like PayPal, Venmo, or credit card companies. It reports gross rental payments processed through these platforms.

Where to report rental payments:

Rental payments processed via payment cards or third-party networks are included in Box 1a – Gross payment amount of Form 1099-K.

Key Rental Use Case:

If a landlord or property manager receives $5,000 or more in rent via online platforms, the payment processor must issue Form 1099-K to report these transactions.

Example:

A landlord collects $1,000 per month from 5 tenants via a rental payment app like Cozy or PayPal. The platform will issue a Form 1099-K showing $6,000 in Box 1a, the total gross payments.

Deadlines for Filing 1099 Forms for Landlords

The IRS sets strict deadlines for issuing and filing 1099 forms. Missing these deadlines can result in penalties.

| Form Type | Send to Recipient By | File with IRS (Paper) | File with IRS (Electronically) |

| 1099-MISC | Jan 31 | Feb 28 | March 31 |

| 1099-K | Jan 31 | Feb 28 | March 31 |

Tip: Use Form 1096 if you’re filing 1099s by paper.

What Should Landlords and Property Managers Do with 1099 Forms?

If you receive a 1099-MISC or 1099-K:

- Verify the accuracy of the amounts.

- Match the income with your rental records.

- Report the income on Schedule E (Form 1040) or your business return.

- Keep the form with your tax documentation.

If you issue a 1099-MISC:

- Collect a Form W-9 from the landlord or service provider.

- Complete the 1099 form with correct details.

- File it with the IRS and furnish a copy to the recipient.

Who is Exempt from 1099 Rental Income Reporting?

Certain parties are not required to file or receive 1099 forms related to rental income. Common exemptions include:

- Residential tenants (non-business individuals) – not required to issue 1099-MISC to landlords.

- Rental income from personal property not used in a trade or business.

- Tax-exempt organizations, such as nonprofits, for payments not connected to a trade or business.

- Corporations (in most cases) do not need to receive a 1099 for rent paid to them unless it’s for legal or medical services.

- Payments made with a credit card or third-party network—these are reported via 1099-K, not 1099-MISC.

Final Thoughts

Understanding the IRS requirements around rental income and 1099 reporting is essential for staying compliant and avoiding penalties. Whether you’re a commercial tenant filing Form 1099-MISC, a landlord receiving income through online platforms triggering Form 1099-K, or a property manager coordinating rental payments, proper documentation and timely reporting are key.

If you’re unsure, consult a tax professional or accountant to determine which forms apply to your rental transactions. The IRS has stepped up its enforcement around third-party payments and rental income reporting—so getting it right is more important than ever.