When it comes to employment tax forms in the United States, two essential documents often cause confusion: Form W-2 and Form W-4. Both are crucial for tax compliance, but they serve entirely different purposes. Understanding the differences between these forms is important for both employers and employees to ensure accurate tax reporting and withholding.

What is a W-2 Form?

The W-2 form, also known as the Wage and Tax Statement, is used by employers to report employees’ wages, tax withholdings, and other compensation details to the Social Security Administration (SSA) and the IRS. Employers must provide this form to their employees each year so they can use it when filing their tax returns.

Key Facts About the W-2 Form:

Form W-2 is used to report wages paid to employees and the taxes withheld. Required for every employee who earns $600 or more annually.

Employers must file it with the SSA and distribute copies to employees by January 31st each year. Employees use it to file their annual income tax returns.

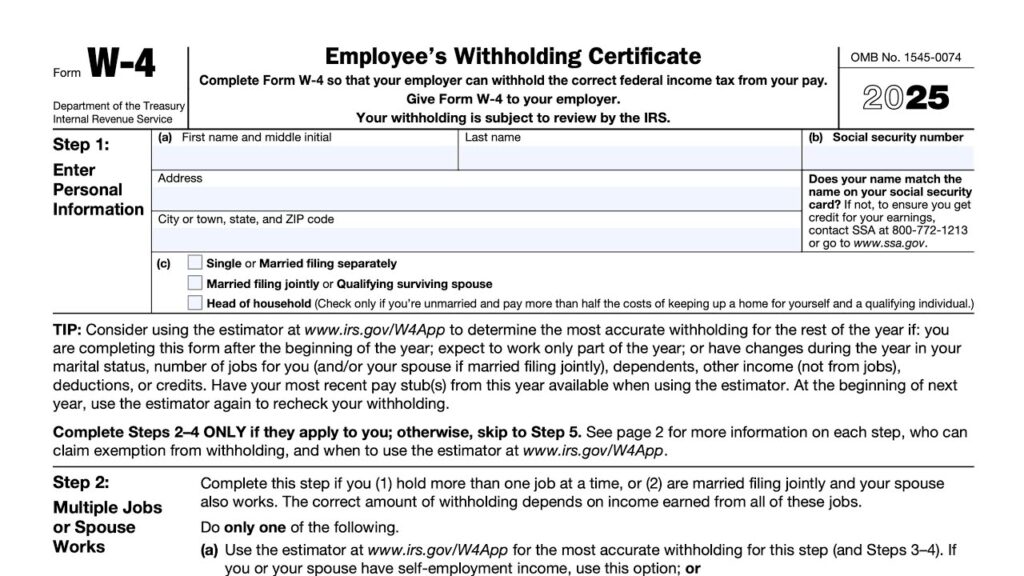

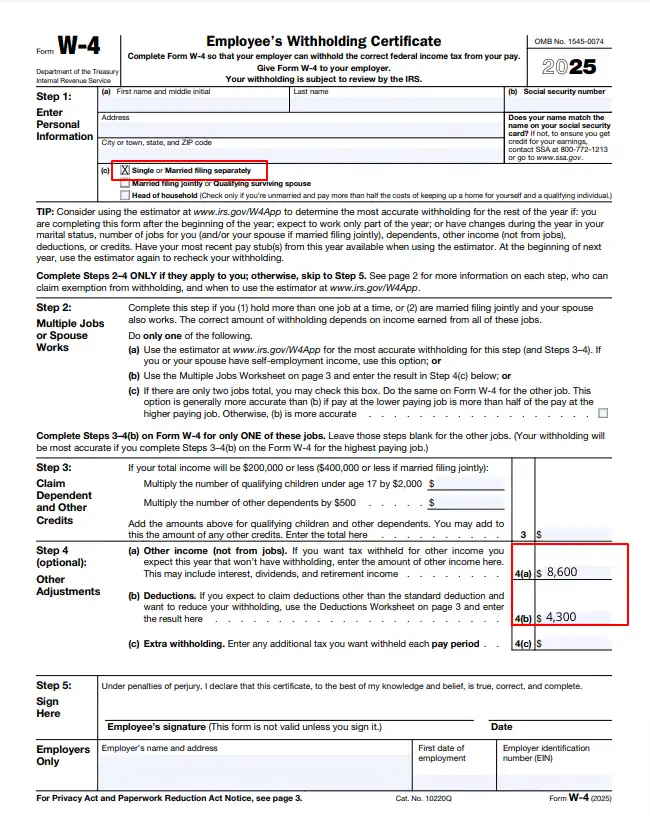

What is a W-4 Form?

The W-4 form, known as the Employee’s Withholding Certificate, is filled out by employees when they start a new job. This form tells the employer how much federal income tax to withhold from their paycheck based on their filing status, dependents, and other adjustments.

Key Facts About the W-4 Form:

- Used by employees to determine tax withholding from their wages.

- Must be completed when starting a new job or when an employee wants to change their tax withholding.

- No filing deadline—it is submitted to the employer and not sent to the IRS or SSA.

- Helps employees adjust their withholding to avoid underpaying or overpaying taxes.

Major Differences Between W-2 and W-4

| Differences | W-2 Form | W-4 Form |

| Purpose | Reports wages and tax withholdings to SSA & IRS | Determines tax withholding from paycheck |

| Who Fills It Out? | Employer | Employee |

| When Is It Used? | At year-end for tax reporting | When starting a job or updating withholdings |

| Deadline | January 31 (for employer submission to SSA & employees) | No deadline (provided to employer before first paycheck) |

| Who Receives It? | Employees, IRS, SSA, State tax agencies | Only the employer (not sent to IRS/SSA) |

| Is It Mandatory? | Yes, for all employees earning $600+ | Yes, for all employees |

| What Happens If Not Submitted? | Employee may not receive proper tax reporting | Employer will withhold taxes at the highest rate |

Why Are These Forms Important?

Understanding the difference between W-2 and W-4 helps both employees and employers:

For employees: Properly completing a W-4 ensures accurate tax withholding, preventing unexpected tax bills or refunds. A W-2 is essential for filing annual tax returns.

For employers: Filing W-2 forms on time avoids IRS penalties, while collecting W-4s ensures proper payroll tax deductions.

Conclusion

While both W-2 and W-4 forms are critical for payroll and tax compliance, they serve different functions—W-4 is for tax withholding adjustments, and W-2 is for tax reporting. Employers must ensure they collect W-4s from new hires and file W-2s annually to stay compliant with tax laws. Employees should update their W-4 if their financial situation changes and use their W-2 to file accurate tax returns.