Even the most careful payroll departments and tax professionals occasionally make mistakes when filing IRS Form 941, the employer’s quarterly federal tax return. When that happens, you don’t need to panic. The IRS provides a formal correction method using Form 941-X.

In this updated 2025 guide, we’ll explain:

- What Form 941-X is

- What types of errors it can correct

- The filing deadline

- And how to file — including the new e-file option now available in 2025.

What is Form 941-X?

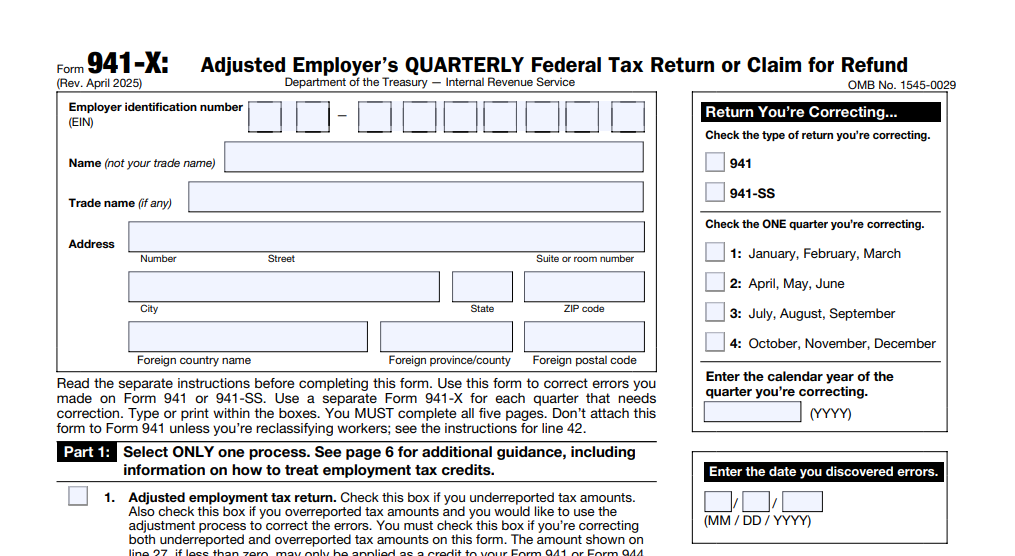

Form 941-X, officially titled “Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund,” is the form used to correct errors on previously filed Form 941.

Employers use Form 941 to report wages paid, payroll taxes withheld, and the employer’s share of Social Security and Medicare taxes. But if you discover a mistake after filing — whether it’s overreporting, underreporting, or misclassifying — you’ll need to use Form 941-X to fix it.

It’s ensures that your tax records are accurate and up-to-date, which is critical for both compliance and future IRS audits.

What Can You Correct with Form 941-X?

Form 941-X allows employers to adjust or amend nearly every part of the original Form 941. Here’s a breakdown of common corrections:

✅ 1. Wages and Compensation

- Incorrect total wages, tips, or other compensation

- Qualified sick or family leave wages (especially from COVID-19-related credits)

✅ 2. Income Tax Withholding

- Mistakes in the federal income tax withheld from employee pay

✅ 3. Social Security and Medicare Taxes

- Overreported or underreported Social Security and Medicare amounts

- Employee and employer portions

- Additional Medicare Tax adjustments

✅ 4. Tax Credits

- Correcting refundable tax credits such as:

- Employee Retention Credit (ERC)

- Paid Sick and Family Leave Credit

- COBRA Premium Assistance Credit

✅ 5. Misclassified Workers

- Reclassifying an employee as an independent contractor or vice versa

✅ 6. Overreported or Underreported Tax Liability

- Adjusting Schedule B (if applicable)

- Fixing erroneous deposit schedules

ℹ️ Note: Each Form 941-X can only be used to correct one quarter at a time.

Deadline to File Form 941-X

The deadline to file Form 941-X depends on whether you are claiming a refund or adjustment, and when you originally filed and paid the tax.

📌 If Claiming a Refund or Credit:

You must file within 3 years of the original due date of the Form 941 or within 2 years from the date the tax was paid — whichever is later.

Example: If you filed your Q1 2022 Form 941 by April 30, 2022, and paid on time, you have until April 30, 2025 to file a 941-X for that quarter.

📌 If Correcting an Underpayment (Adjustment Only):

There is no time limit, but you must pay any additional tax due promptly, and interest may apply.

Related Post: Form 940 Filing Guide for Small Business Owners

How to File Form 941-X (Updated for 2025)

Filing Form 941-X used to mean printing, signing, and mailing a paper form. But starting in 2025, the IRS now accepts Form 941-X electronically, which streamlines the correction process significantly.

Here’s a step-by-step guide:

1. Identify the Quarter

Each 941-X must apply to a single quarter. Make sure to clearly indicate the quarter and year you’re correcting.

2. Complete the Form

Include:

- The original reported amounts

- The corrected amounts

- The difference

- A detailed explanation of the correction in Part 4

Be clear and specific — vague explanations can delay processing.

3. Choose: Refund or Adjustment

- If you overpaid, indicate whether you’re requesting a refund or applying a credit to a future return.

- If you underpaid, select “adjustment” and remit the balance due.

4. E-File the Form (New in 2025)

You can now file Form 941-X electronically through:

- IRS-approved e-file software

- Authorized payroll providers or tax professionals

✅ Not all tax platforms offer 941-X e-filing yet, so double-check your software or service provider.

E-filing speeds up processing time and reduces the chances of errors due to mailing or manual data entry.

5. Maintain Records

Keep copies of:

- The original and corrected returns

- Any supporting documentation

- Proof of e-filing or mailing

Common Scenarios That Require Form 941-X

Here are a few real-world situations where you’ll need to file a 941-X:

- You discovered a misclassification of employees after an audit

- Payroll software failed to include wages for a bonus run

- You forgot to apply the Employee Retention Credit in a prior quarter

- A reporting error overstated your federal tax deposits

Each of these situations can be corrected cleanly and properly through Form 941-X.

Final Thoughts

Correcting payroll tax errors is never fun — but it’s a critical part of staying compliant with IRS rules. Whether you’re fixing an overpayment or underreporting issue, Form 941-X is your go-to tool to make those corrections official.

With the new e-file option in 2025, it’s now faster and more efficient to submit corrections than ever before. Just be sure to follow the deadlines, explain your changes clearly, and keep excellent records.

If you’re unsure about filing Form 941-X or want to avoid penalties and delays, consult with a qualified tax professional or payroll service provider who can help navigate the process.